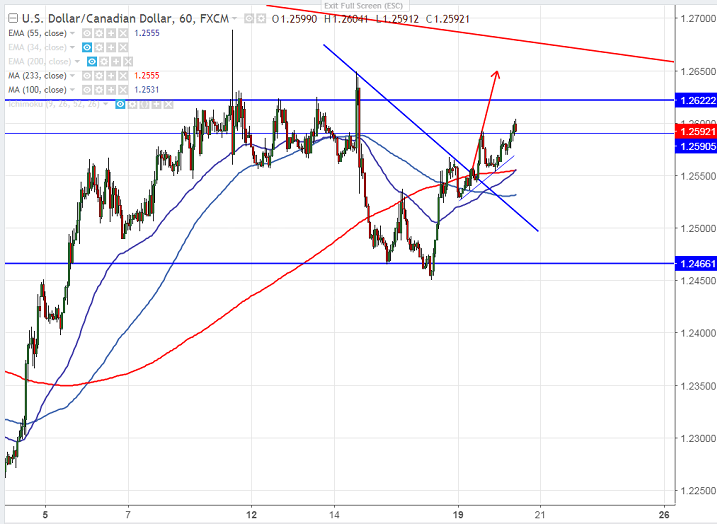

- USD/CAD is continuing its bullish trend for third consecutive day. The pair has broken trend line resistance at 1.25580 and jumped till 1.25938 at the time of writing. It is currently trading around 1.25900.Overall jump in USD/CAD is due to bounce in US dollar index. DXY shown a good jump almost 0.40% higher today and hits high of 89.64. It is currently trading around 1.25940.

- Oil prices is in consolidation after a good recovery from the low of $58.05 till $62.62. Crude oil prices upside is limited due to increase in US rig count for fourth consecutive week.

- On the higher side, major resistance is around 1.26000 and any break above will take the pair till 1.26490/1.26880.

- The near term support is around 1.2530 (55- day EMA) and any break below will take the pair till 1.2450/1.2435. Overall bearish continuation only below 1.2245.

It is good to buy on dips around 1.2575 with SL around 1.2535 for the TP of 1.26400/1.2680.

Resistance

R1-1.2600

R2 – 1.2649

R3-1.2680

Support

S1-1.2535

S2-1.2490

S3- 1.2450