Canadian dollar firmed against US dollar on Wednesday, after Canadian dollar gathered some momentum after crude oil price rebounded erasing a brief dip after data showed huge build in US crude stockpiles.

- The intraday trend remains bearish for the pair as the oil-correlated Canadian dollar is set to strengthen against dollar in the short term.

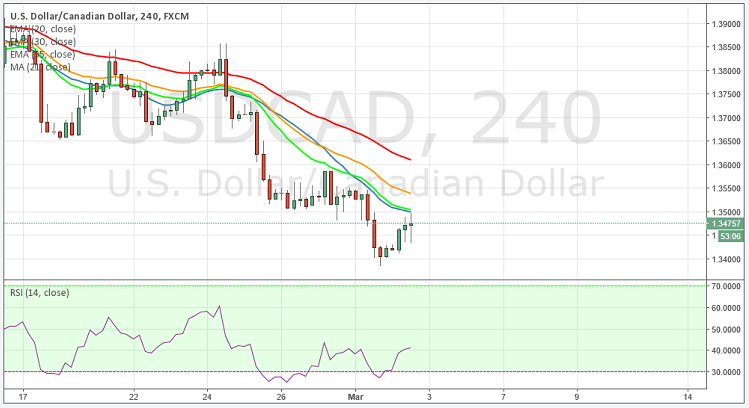

- Technically the pair has extended its decline below its 55 DMA, the RSI in the 4 hour chart is indicating downwards at 47, meanwhile the 55, 30 and 20 MA's are pointing strong bearish momentum towards lower side. Overall the technical indicators are depicting further downtrend for this pair.

- The immediate support can be seen at 1.3432, break below this level will expose the pair to next support level at 1.3405.

- Major resistance can be seen at 1.3493, break above this level will expose it towards 1.3545 levels.

Recommendation: Go short around 1.3490 with targets at 1.3405, 1.3350 SL 1.3580.

Resistance Levels

R1: 1.3493 (50% Retracement level)

R2: 1.3545 (March 2nd high)

R3: 1.3581 (61.2% Retracement level)

Support Levels

S1: 1.3432 (Session low)

S2: 1.3405 (38.2% Retracement level)

S3: 1.3300 (23.6% Retracement level)