The USD/CAD pair surged higher on Wednesday, as oil prices plummeted towards 27.86 $ per barrel.

- Oil prices rebound waned in US session after data showed surprise drop in US crude stockpiles causing worries of global supply glut.

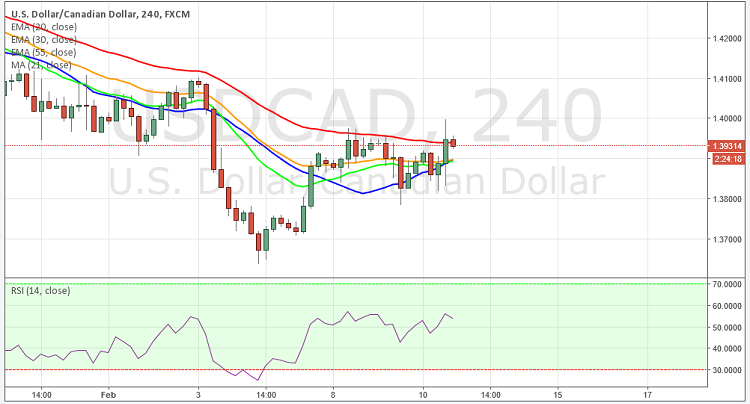

- The short term picture favors further advances, as the price is now well above 21 DMA, whilst the technical indicators slowly gaining strength. In the 4 hours chart, the MA's 55, 30, 20 is slowly changing direction towards upside. The RSI indicator is in positive territory at 54.

- To the upside, the strong resistance can be seen at 1.4040, a break above will take the pair towards next resistance level at 1.4111.

- To the downside immediate support can be seen at 1.3880 levels, a break below will open the door towards next level at 1.3800.

Recommendation: Go long around 1.3860 targets 1.3950, 1.4090, SL 1.3770

Resistance Levels

R1: 1.4040 (38.2% Retracement level)

R2: 1.4111 (Feb 3rd high)

R3: 1.4226 (23.6% Retracement level)

Support Levels

S1: 1.3880 (50% Retracement level)

S2: 1.3800 (Psychological levels)

S3: 1.3728 (61.8% Retracement level)