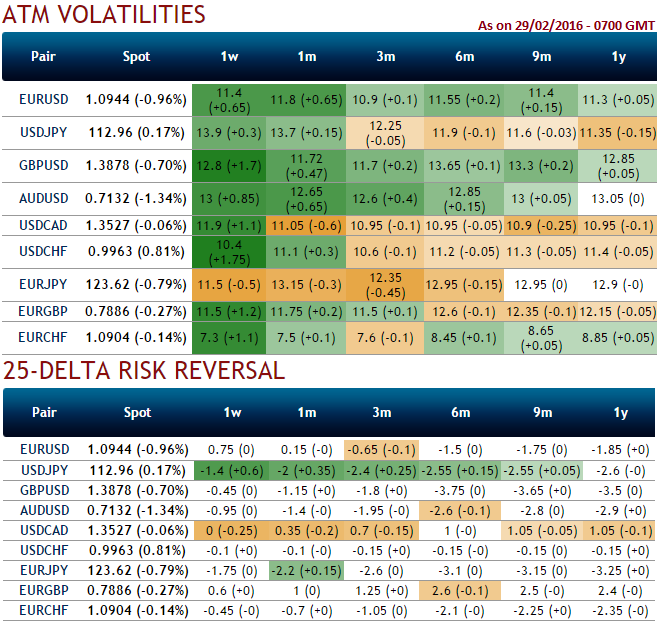

25 delta risk reversal for USDCAD has gradually been reducing its positive numbers (see negative numbers in brackets), just three months ago the hedging sentiments were to mitigate the upside risks, these positive numbers were at even higher levels.

When a risk reversal position is selling for a net credit what is known as a "Negative Risk Reversal"), it means that put options are more expensive than call options due to higher implied volatility of put options. This implies a Bearish sentiment.

In fact, in forex options trading, risk reversals are directly quoted based on implied volatility so that its even easier to see which way investor sentiment is inclined towards.

While on the other hand, implied volatility quotes for these risk reversals are also collapsing gradually (reduced from 11.9% for 1W expiries to 10.95% for next 3-6M expiries), these are used as benchmarks to create a volatility surface.

You would enter into a risk reversal if you want to hedge your underlying risk while lowering the cost of this premium.

Since, the spot FX is trading at 1.3573 with implied volatility of ATM contracts marginally inching higher (at 11.9%) and its delta neutrality, we believe CAD's gain is majorly due to crude holding stronger.

Hence, the recommendation for short term hedgers is buying 1W (-1%) OTM -0.26 delta put, shorting ATM put with similar expiries and simultaneously buy 1W (1%) ITM -0.71 delta put while simultaneously shorting another ATM put with similar expiries.

This strategy is structured for a larger probability of earning a smaller but certain profit as USDCAD is likely to lose momentum in its IVs.

Nevertheless, for long time hedgers diagonal call spreads are advised as below,

An options spread consists of buying a call in the deferred month expiration and selling a call in the near month expiration at a different strike price is preferred.

Diagonal Call Spread: (USDCAD)

Spread ratio: (Long 1: Short 1)

Go long in USDCAD (1%) in the money +0.65 delta call of mid month expiry and Short USDCAD (1%) out of the money call of near month expiry with positive theta.

FxWirePro: USD/CAD risk reversals consolidating, IVs reducing - butterfly spreads for short term but diagonal spreads to hedge long term risks

Monday, February 29, 2016 11:26 AM UTC

Editor's Picks

- Market Data

Most Popular