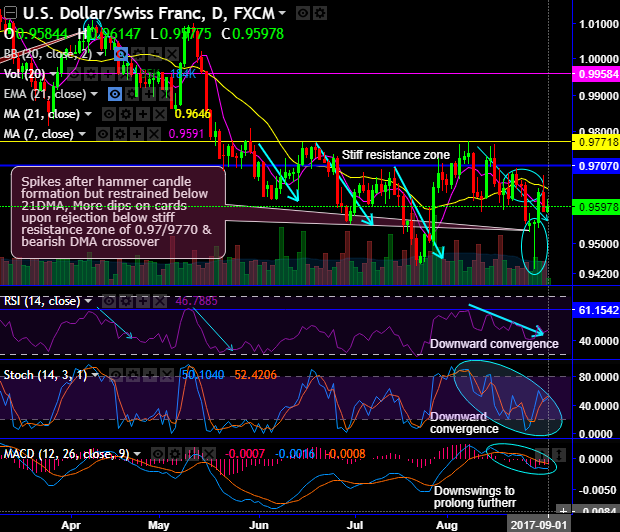

USDCHF rejects at major resistances of 0.9770 and 0.97 levels. Ever since it has dropped at this resistance level you see consistent price drops. In the recent past, you could figure out bearish candles (such as shooting stars at 0.9741 and 0.9726 levels) that evidence slumps, now signal more weakness in this pair. Moreover, 7DMA crosses below 21DMA which is the bearish DMA crossover, the current price slides below DMAs.

To substantiate this bearish stance, both leading oscillators (RSI & stochastic) have consistently been converging to the price slumps.

On the slip side, you could see spikes after the formation of hammer candle but restrained below 21DMA.

USDCHF price behavior in the major trend slides back to remain in the long lasting range bounded trend (refer monthly chart) for now, attempting to breach below EMAs.

Strong support in the major trend is seen at 0.9439 levels, if it manages to break below strong support decisively on a closing basis (which seems most likely), then expect more slumps upto 0.9060 levels as MACD still signal most likely extension of slumps.

This bearish sentiment is backed by the momentum signaled by leading oscillators on monthly terms as well.

Use mid-month futures to short hedge. Hence, at spot ref: 0.9597 we advocate arresting bearish risks by initiating shorts in futures contracts of mid-month expiries by keeping a strict stop loss at around 0.9662 levels.

While the FxWirePro currency strength index for the USD has been neutral by flashing a shy above 32 (neutral), while CHF has also been little bullish by flashing +53.

For more details on our index please visit below weblink:

http://www.fxwirepro.com/fxwire/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit: