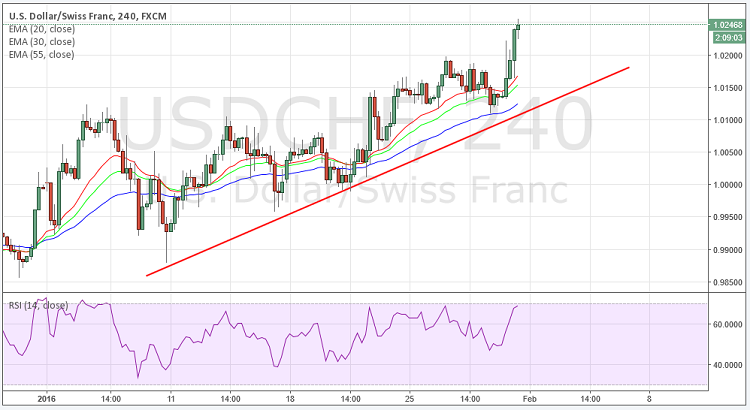

The USD/CHF rebounded from 1.0200 levels to hit high at 1.0241 levels, after the release US GDP data which came in line with the expectations at 0.7%. However, dollar gained strength on the day broadly due to unexpected negative interest rate decision by Bank of Japan.

- The short term outlook for the pair remains bullish, as the pair is supported by rising trend line in 4 hour chart, the relative index is pointing upwards at 61, the 55, 30 and 20 MA's is indicating upward momentum . Overall the technical indicators are depicting upside for this pair.

- To the upside, the strong resistance can be seen at 1.0272, a break above this level would take the pair towards next resistance level at 1.0300.

- To the downside strong support can be seen 1.0219, a break below this level will take the pair to next level at 1.0188.

Recommendation: Go long around 1.0220, targets 1.0280, 1.0350, SL 1.0000

Support levels: 1.0241, 1.0219, 1.0188

Resistance levels: 1.0272, 1.0305, 1.0342