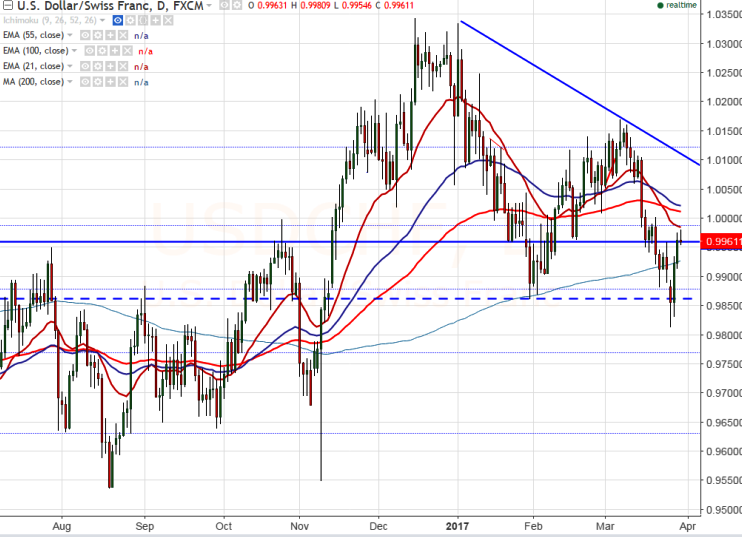

- Major resistance – 0.9960

- The pair shown mild jump till 0.9980 after breaking above 0.9960 level. It is currently trading around 0.99665.

- Any break above 0.9960 will push the pair till 1.00230 (55- day EMA) and any sustained close above indicated that decline from 1.03435 got completed at 0.98136.The pair should break above 1.0170 for further bullish confirmation. The near term resistance are at 1.00783 (61.8% retracement of 1.03435 and 0.98136)/1.0120.

- On the lower side, near term support is around 0.9912 (200- day MA) and any break below 0.9912 targets 0.98600/0.98100.

It is good to buy above 0.9960 with SL around 0.9900 for the TP of 1.0027/1.00780.

Resistance

R1-1.000

R2 -1.0023

R3- 1.0078

Support

S1-0.99120

S2-0.9860

S3-0.9800