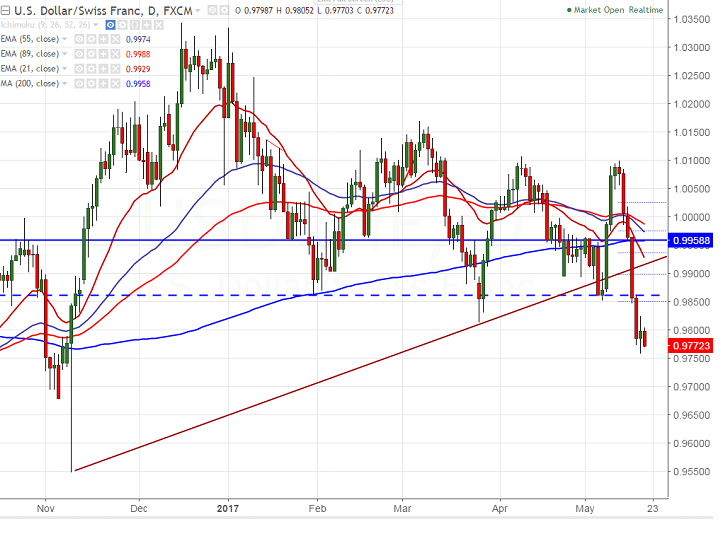

- USD/CHF continues its losing streak for the fifth consecutive days and has closed well below the major support at 0.9812 low formed on Mar 27th 2017. The pair hits 0.97590 yesterday and is currently trading around 0.97885.

- The break below 0.98120 confirms that jump from 0.95493 comes to an end at 1.03400 and a dips till 0.9617 (100% projection from 1.03420 to 0.9860 from 1.0099) is possible. The near term major support is around 0.9750/0.9705 (50% retracement of 0.90719 and 1.03436) /0.9640.

- On the higher side near term resistance is around 0.9860 and any break above will take the pair till 0.9900/0.9960 (200- day MA).The pair is neutral phase for the long term and it should break above 1.03435 for further bullishness.

It is good to sell on rallies around 0.97850-0.9790 with SL around 0.9860 for the TP of 0.9710/0.9620.

Resistance

R1-0.9860

R2 -0.9900

R3- 1.000

Support

S1-0.9750

S2-0.9705

S3-0.9620