The funding cost of CNH dropped significantly this week, with the HIBOR overnight rates easing to below 3% this morning. In the meantime, the CNY-CNH spread has narrowed significantly. In our view, this is due to the arbitrage flows as corporates took advantage of the wide CNY-CNH spread. In addition, the short CNH positions could start to pick up again with a lower carry cost. Bottom line: the pressure on CNY exchange rates persists, and the market intervention won’t change the market expectations at all.

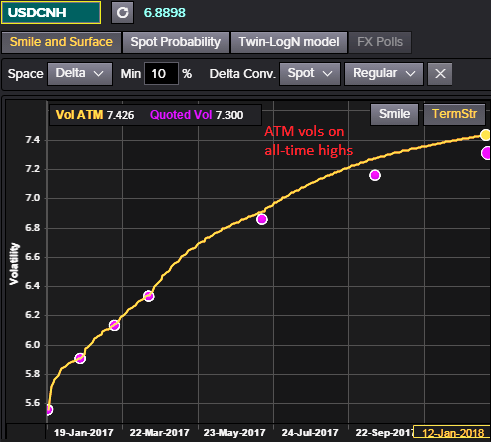

The biggest talking point of the New Year is the shellacking that China bears have received on consensus long USDCNY positions, engineered via the by-now familiar tool of raising FX implied yields to punitive levels. As you could observe from the diagram showing ATM and implied vols have collapsed and risk-reversals are also likely to collapse alongside the liquidation of USD longs, a chasm has now opened up between implied yields in CNH forwards and option prices that is testing historical extremes along a number of dimensions:

Carry/vol in ATMF USD puts/CNH calls and ATMF – ATMS USD put/CNH call spreads is at multi-year highs. However, a strong dollar through 1H remains the baseline despite the rinse in CNH and related short Asian FX positions this week, so this carry/vol extreme is tricky to monetize unless one subscribes to a contrarian notion of stable or lower USDRMB spot from current levels.

This isn’t out of the question if the bullish dollar thesis comes apart in coming months, but is low odds otherwise since CNY should weaken vs. USD alongside partner currencies in a basket framework that remains the fulcrum of Chinese FX policy (as signaled via an expansion of the CFETS basket in late December). It is possible for USDCNH spot to fall short of current FX forwards by the end of the year despite RMB weakness (1y CNH forward @ 7.17 vs. our Dec’17 target @ 7.10), but the ride along the way is likely to prove bumpy and terminal returns unexciting.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays