• USD/ CNY recovered some ground on Monday after data showed China's Aug manufacturing returns to growth.

• China's manufacturing sector rebounded in August, with increased new orders driving production growth, a private-sector survey showed on Monday.

• The Caixin/S&P Global Manufacturing PMI rose to 50.4 in August, up from 49.8 in July, exceeding the 50 forecasted by analysts.

• At GMT 03:56,the dollar recovered against Chinese Yuan. It was up 0.18% at 7.102

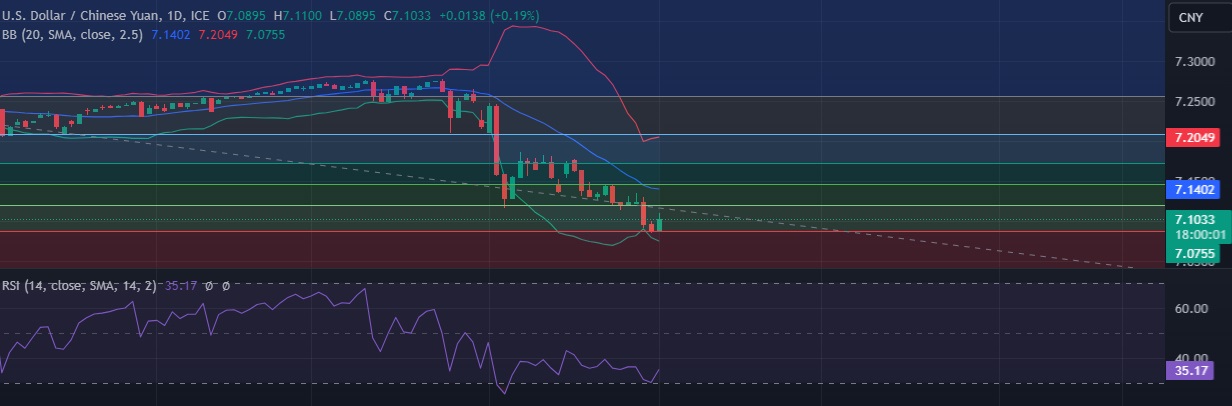

• Technical signals are bearish as RSI is at 34, daily momentum studies 5, 9 and 10 DMAs are trending down.

• Immediate resistance is located at 7.1291 (Daily high), any close above will push the pair towards 7.1487(50%fib).

• Support is seen at 7.1163(23.6%fib) and break below could take the pair towards 7.1100 (Psychological level).

Recommendation: Good to sell around 7.1050 with stop loss of 7.1600 and target price of 7.0700