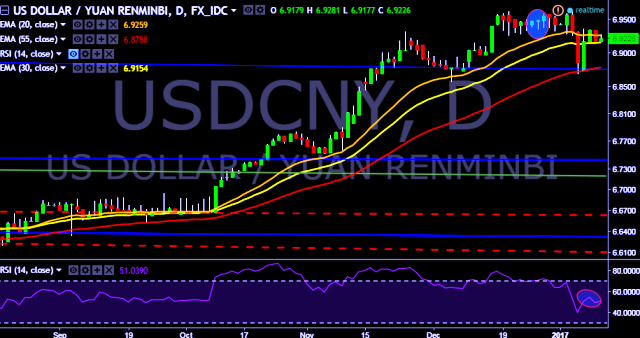

- USD/CNY is currently trading around 6.9223 marks.

- It made intraday high at 6.9281 and low at 6.9177 levels.

- Intraday bias remains neutral for the moment. .

- A sustained close above 6.9179 marks will test key resistances at 6.9349, 6.9496, 6.9615, 6.9778 and 6.9883 marks respectively.

- Alternatively, a daily close below 6.9175 will drag the parity down towards key supports at 6.8983, 6.8720, 6.8510 and 6.8449 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart.

- PBOC sets Yuan mid-point at 6.9235/ dollar vs last close 6.9245.

We prefer to take long position in USD/CNY around 6.9190, stop loss 6.8983 and target of 6.9496.