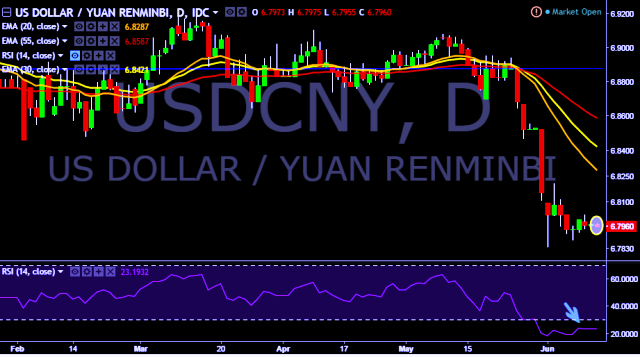

- USD/CNY is currently trading around 6.7962 marks.

- It made intraday high at 6.7975 and low at 6.7955 levels.

- Intraday bias remains neutral for the moment.

- A sustained close above 6.7973 marks will test key resistances at 6.8030, 6.8116, 6.8298, 6.8354, 6.8671, 6.8882, 6.8942, 6.9010 marks 6.9080 marks respectively.

- Alternatively, a daily close below 6.7970 will drag the parity down towards key supports at 6.7888, 6.7769, 6.7626, 6.7520 and 6.7436 marks respectively.

- PBOC sets yuan mid-point at 6.7954/ dlr vs last close 6.7988.

Positioning is inconclusive at this point, with prices offering no clear cut signal to initiate a long or short trade. We will continue to remain on sidelines for the time being.