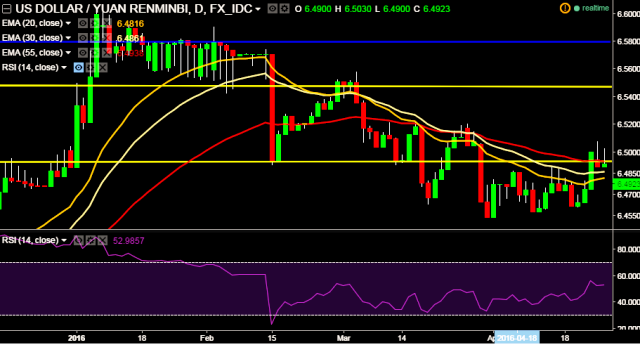

- Pair is currently supported above 6.49 marks and trading around 6.4933 levels.

- It made intraday high at 6.5030 and low at 6.4900 levels.

- Today PBOC sets Yuan mid-point at 6.4882 / dollar vs last close 6.4945.

- Intraday bias remains bullish till the time pair holds key support at 6.4910 levels.

- A daily close below 6.4910 will drag the parity down towards key supports at 6.4736/6.4531 levels.

- On the other side, a sustained close above 6.5182 will test key resistances at 6.5525 and 6.5708 levels.

We prefer to take long position in USD/CNY around 6.4925, stop loss 6.4910 and target 6.5117 levels.