- The Danish Krone rebounded from a near 2-week trough hit in the prior session, as the greenback eased following the U.S. Federal Reserve's second emergency rate cut.

- The U.S. Federal Reserve cut interest rates for the second time in less than two weeks on Sunday, reducing to a target range of 0 percent to 0.25 percent amid the economic impact of the coronavirus outbreak.

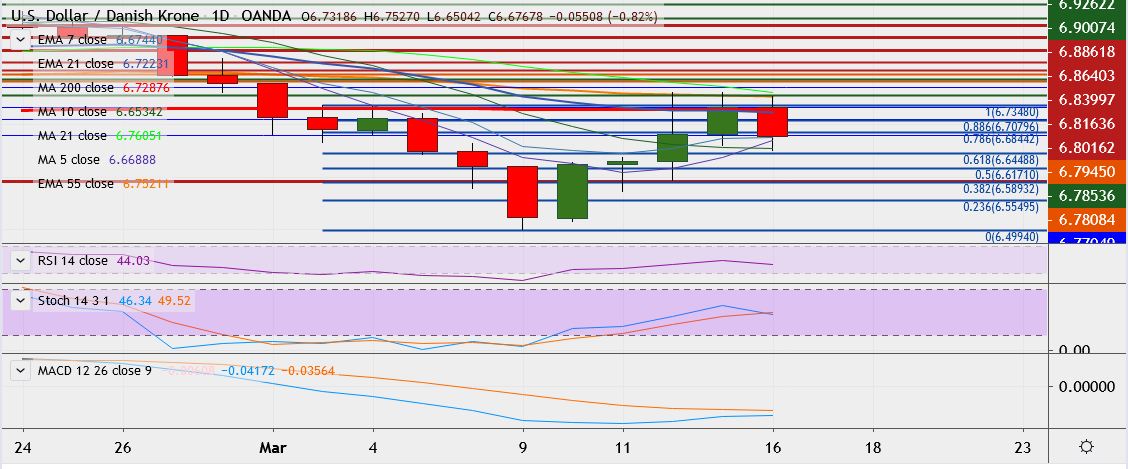

- USD/DKK is trading 0.8 percent down at 6.6760, having hit high of 6.7604 on Friday, its highest since March 2.

- Momentum indicators are bearish - RSI weak at 44, MACD supports downside and Stochs indicate a bearish crossover.

- Immediate resistance is located at 6.7709 (21-DMA), close above could take it till 6.7771.

- On the downside, support is seen at 6.6426, and any break below will take it till 6.6380 (5-DMA).

Recommendation: Good to sell on rallies around 6.7268, with stop loss of 6.7604 and target price of 6.6426,