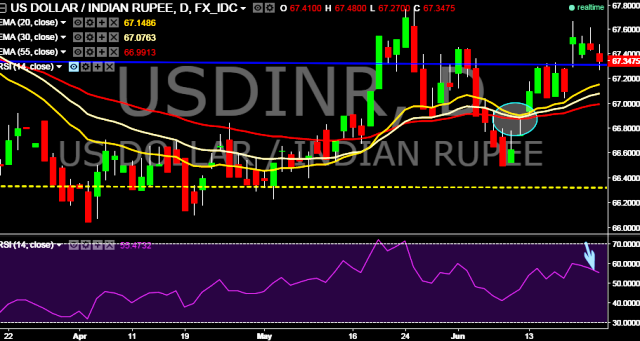

- USD/INR is currently trading around 67.36 marks.

- It made intraday high at 67.48 and low at 67.27 marks.

- Intraday bias remains bearish till the time pair holds key resistance at 67.62 marks.

- Key resistances are seen at 67.45, 67.52, 67.81, 68.05 (crossover of 20D, 30D and 55D EMA) and 68.35 (March 1, 2016 high) respectively.

- On the other side, initial supports are seen at 67.37, 67.17, 66.91, 66.75, 66.42(May 01, 2016 low), 66.32 (November 2015 low), 66.23, 66.10, 65.95 and 65.81 marks respectively.

- In addition, India’s BSE Sensex was trading 0.11% higher at 26,794.40 and NSE Nifty was down by 0.04% to 8,200.10 points.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend. Current downside movement is short term trend correction only.

We prefer to take short position in USD/INR below 67.32 with stop loss at 67.52 and target of 67.06/ 66.91 marks.