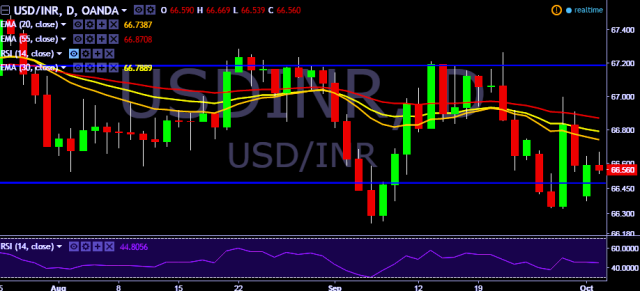

- USD/INR is currently trading around 66.56 marks.

- It made intraday high at 66.66 and low at 66.53 marks.

- Intraday bias remains bearish till the time pair holds immediate resistance at 67.05 marks.

- Key resistances are seen at 66.75, 66.90, 67.05, 67.16, 67.28, 67.52, 67.71, 67.84, 67.95, 68.02, 68.35(March 1, 2016 high), 68.46, 68.66 and 68.78 marks respectively.

- On the other side, initial supports are seen at 66.42(May 01, 2016 low), 66.32 (November 2015 low), 66.21, 66.10, 65.95 and 65.81 marks respectively.

- In addition, India’s NSE Nifty was trading around 0.25 percent lower at 8,747.56 points and BSE Sensex was trading at 0.23 percent lower at 28,270.38 points.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

- India’s repo rate decreases to 6.25 % (forecast 6.50 %) vs previous 6.50 %.

- India’s reverse repo rate decreases to 5.75 % (forecast 6.00 %) vs previous 6.00 %.

- India’s cash reserve ratio stays flat at 4 % (forecast 4.00 %) vs previous 4.00 %.

We prefer to take short position in USD/INR around 66.62, stop loss at 66.92 and target of 66.32/66.24.

FxWirePro: USD/INR stabilizes above 66.50 after RBI rate decision, bias remains bearish

Wednesday, October 5, 2016 5:34 AM UTC

Editor's Picks

- Market Data

Most Popular