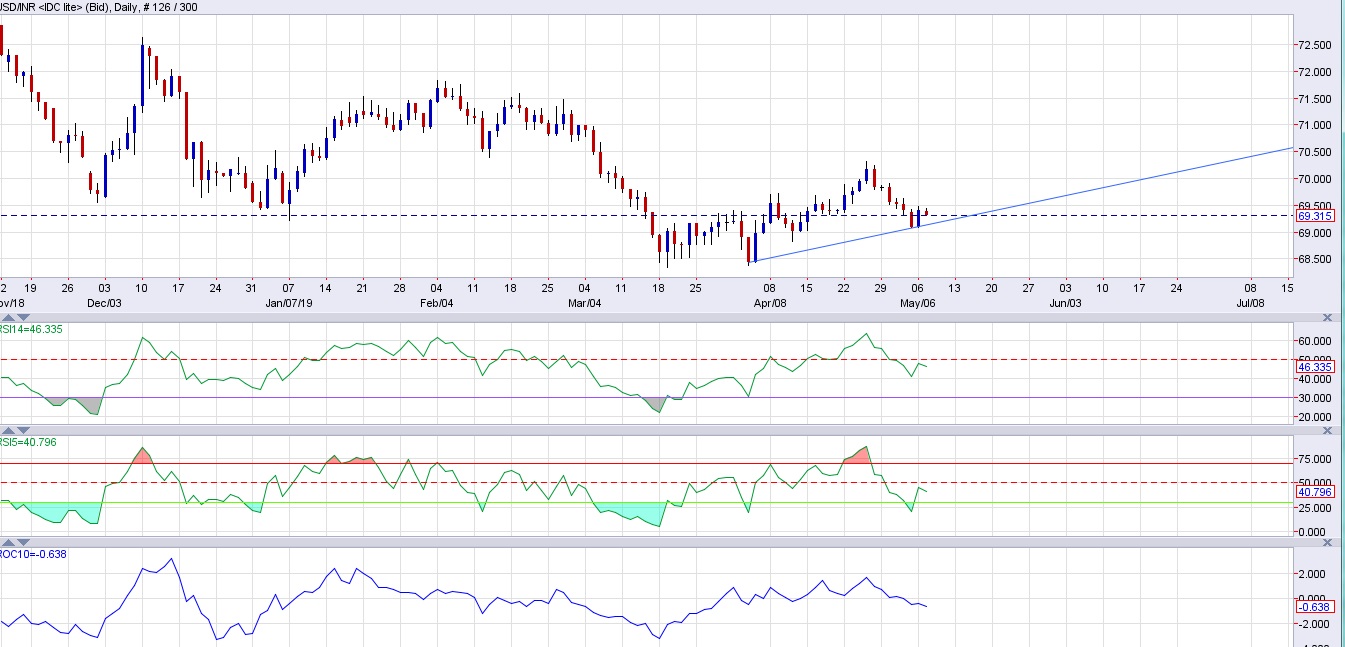

We expect the Indian rupee to lose grounds against the USD in the short-term,

- First of all, there has been a shift in the retail sentiment, which has so far been one of the reliable short-term indicators. Retail sentiment data from the USD/INR are largely used as a contrarian indicator since the retail sentiment tends to move in the opposite direction of the market.

- The most popular options market sentiment indicator is the put-call ratio (PCR). On 25th of April, the retail sentiment as indicated by the PCR shifted to bullish USD/INR and the exchange rate declined from 70.3 in the cash market to 69.3 as of today. Today, the retail sentiment based on data from the National Stock Exchange (NSE) has once again shifted from bullish USD/INR to bearish USD/INR, which suggests that the exchange rate might actually move higher.

- Moreover, the above chart clearly shows that the price action in USD/INR has formed a bullish engulfing candle in the daily chart, which also points to a higher exchange rate going ahead.

- The price of crude oil, which impacts India’s current account balance as the country imports the majority of its energy needs has also rebounded after hitting $60 per barrel (WTI).

Trade idea:

- We would recommend buying USD/INR and hold it till the next shift in sentiment.

Chart prepared in Netdania net-station.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022