Although USDJPY kept spiking 3-4 days, today changed hands at 100.840, down 0.17%, the pair trades at the largely similar level to that around a month ago.

However, JPY has weakened against most other majors over the period. As a result, JPY has declined by over 1% in trade-weighted terms.

The main view on USDJPY in coming months remains unchanged; we expect the pair to be range bound with some downside risks, mainly due to expected USD weakness, not JPY firmness.

Although we expect USDJPY to break the recent low at 99 at some point in coming months, the pair is unlikely to accelerate its downward moves.

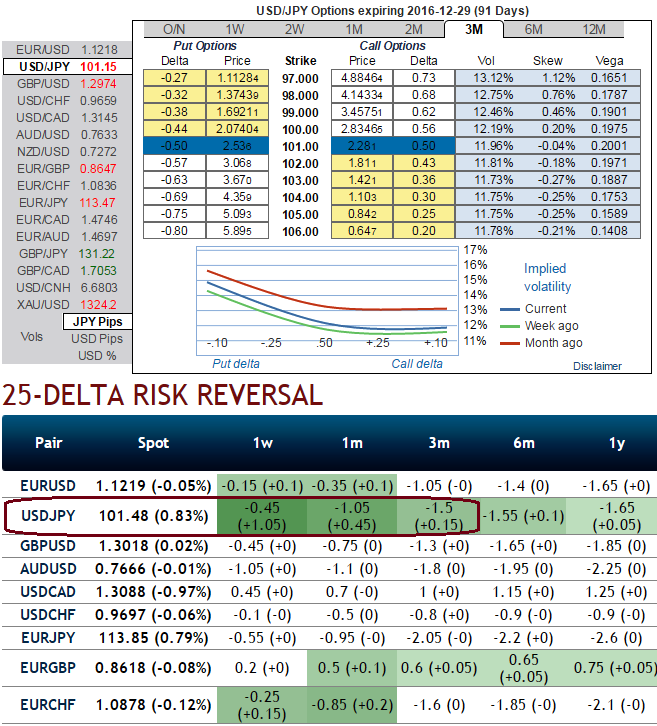

Volatility shocks and the passage of time have opposite effects on the value of a vanilla option (see ATM strikes on USDJPY options). When it can benefit from more volatility (long vega and gamma on OTM put strikes), time has a negative impact every day (short theta).

Yen IVs: Live September meeting should keep 2M vol supported; while yen 1-3m risk-reversals still a better sale as Fed considers global slowdown risks and Bexit settlement which is why the US central bank keeps deferring rate hikes at least until the end of 2016 or by Q1 of 2017.

Please be noted that the 3m IV skews are more biased towards OTM put strikes, significant changes can indicate a change in market expectations for the future direction in the underlying forex spot rate and these risk reversals evidences the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market.

Please be noted that the skewness in implied volatility of 3m tenors of this pair signifies the hedgers interest in OTM put strikes.

While delta risk reversals of the similar expiries reveal more sentiments in hedging activities for downside risks in the similar tenors (3m expiries). This would raise a cause of concern that in this phase of time, the major economic events are likely to intensify volatility in FX markets.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data