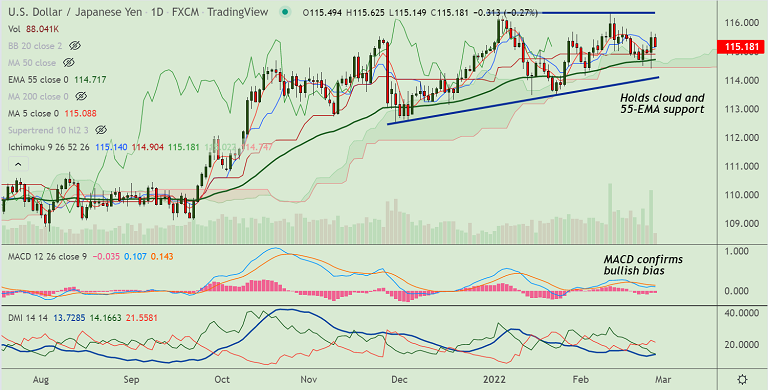

Chart - Courtesy Trading View

USD/JPY was trading 0.24% lower on the day at 115.21 at around 05:30 GMT.

The pair has held above 55-EMA and daily cloud support, weakness only on break below.

GMMA indicator shows major trend is bullish, while minor trend is holding neutral bias.

Cautious optimism prevails over Russia-Ukraine crisis on hopes that US could broker ceasefire deal through NATO.

Thursday’s comments from Russia, like “Moscow is willing to negotiate the terms of Ukraine's surrender,” add to the market’s latest optimism.

On the data front, US Q4 GDP matched 7.0% annualized forecasts. Upbeat Personal Consumption Expenditure, Chicago Fed National Activity Index and Jobless Claims support US dollar strength.

Looking forward, Fed’s key inflation gauge, the Core PCE Price Index, as well as Durable Goods Orders for January will be watched for clues.

Major Support Levels:

S1: 115.11 (21-EMA)

S2: 114.71 (55-EMA)

Major Resistance Levels:

R1: 115.90 (Upper BB)

R2: 116

Summary: USD/JPY technical bias is neutral, geopolitical updates from Russia and Ukraine will influence major market action.