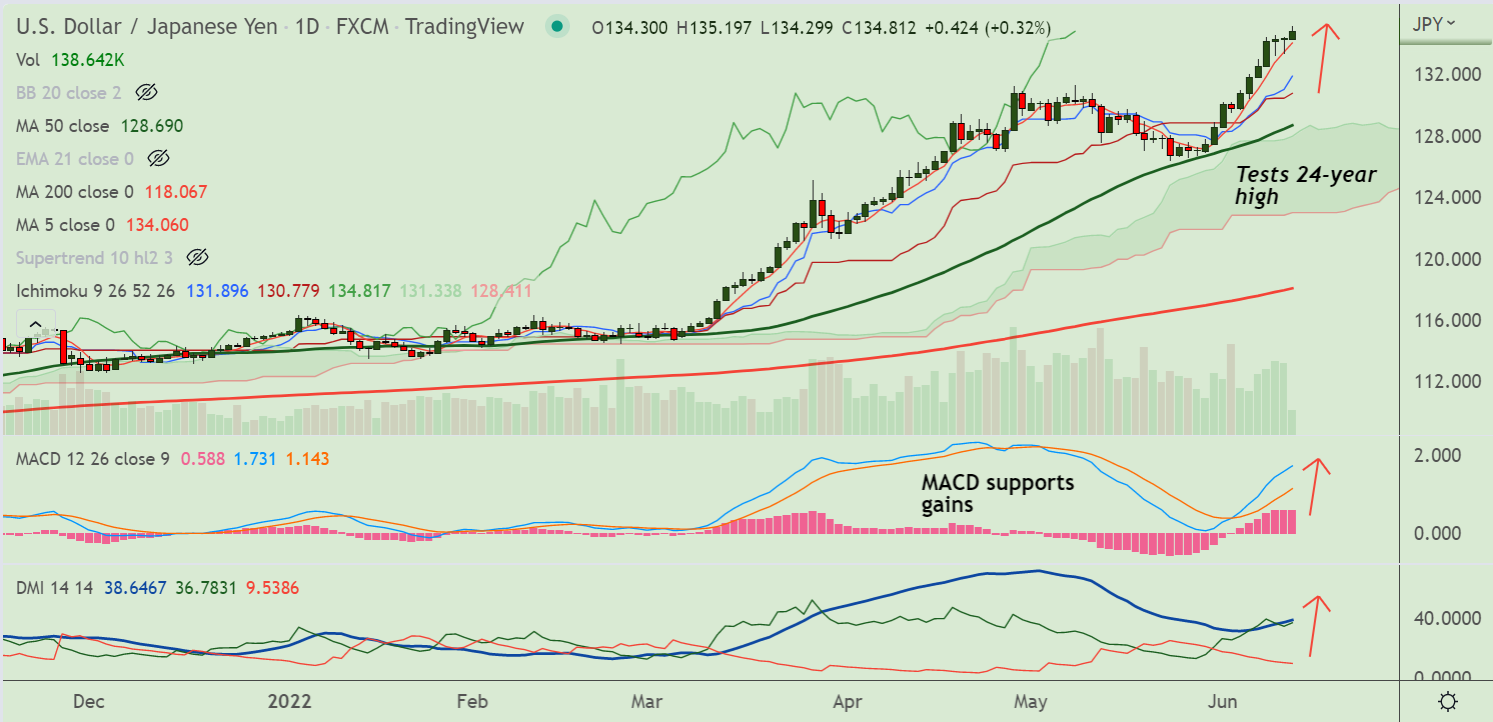

Chart - Courtesy Trading View

USD/JPY was trading 0.35% higher on the day at 134.84 at around 05:40 GMT. The pair broke above 135 handle to hit 24-year high at 135.19 before paring some gains.

Red hot U.S. inflation data drove up Treasury yields, while on the other side, the yen has been sold off amid the Bank of Japan's dovish rhetoric.

US Consumer Price Index (CPI) rose to 8.6% YoY versus 8.3% expected while the Core CPI jumped 6.0% YoY compared to the expected drop to 5.9% from 6.2% a month earlier.

The Bank of Japan (BOJ) has made it clear that it will stick to its ultra-accommodative policy stance.

Bank of Japan (BOJ) Governor Haruhiko Kuroda was on wire earlier on Monday, said that recent sharp yen falls are undesirable and not good for economy.

USD/JPY slipped lower from session highs at 135.19 on jawboning yet again from the Japanese authorities.

Technical analysis for the pair shows a bullish continuation. Momentum with the bulls, volatility is high, scope for further upside.

Major Support Levels:

S1: 134.06 (5-DMA)

S2: 132.01 (200H MA)

Major Resistance Levels:

R1: 135.40 (Upper BB)

R2: 136.89 (Oct 98 high)

Summary: USD/JPY trades with a bullish bias. Scope for test of 136 levels. Weakness only below 21-EMA.