USD/JPY chart on Trading View used for analysis

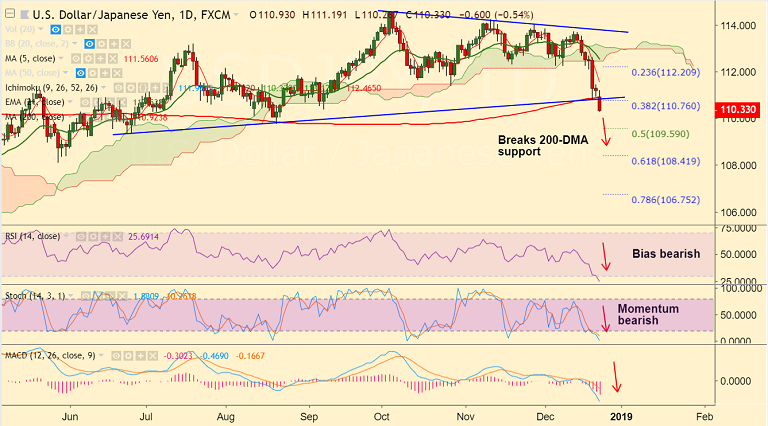

- USD/JPY has slumped below 200-DMA, hits new 4-month lows at 110.26.

- Momentum studies are highly bearish. Close below 200-DMA will see drag till 61.8% Fib at 108.41.

- Data released earlier today showed Japan's Coincident Index came in at 104.9, above expectations (104.5) in October.

- On the flipside, Japan's Leading Economic Index registered at 99.6, below expectations (100.5) in October.

- Sentiment in financial markets remained fragile on fears of a global economic slowdown and continued underpinning the Japanese Yen's safe-haven demand.

- Partial US government shutdown/falling US bond yields keep the USD subdued.

- Momentum with the bears, we see scope for test of 61.8% Fib at 108.41. Retrace above 200-DMA could see some upside.

Support levels - 110.14 (Weekly lower BB), 109.77 (Aug 21 low), 109.59 (50% Fib)

Resistance levels - 110.76 (38.2% Fib), 110.92 (200-DMA), 111.56 (5-DMA)

Recommendation: Good to go short on upticks, SL: 111, TP: 110.15/ 109.80/ 109.60

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data