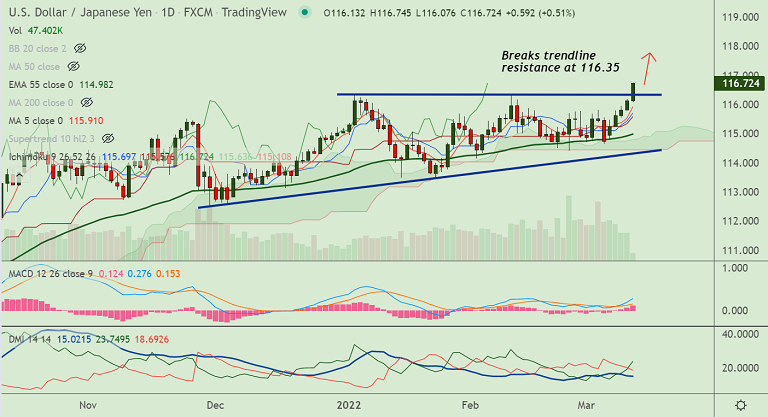

Chart - Courtesy Trading View

USD/JPY was trading 0.48% higher on the day at 116.69 at around 06:00 GMT.

Geopolitical fears join monetary policy contraction and covid fears, to attacks and dent market sentiment supporting the US dollar.

Both the Federal Reserve and the Bank of Japan have policy meetings next week and diverging outlooks further aid upside.

While the Bank of Japan (BoJ) is set to stay on hold with a dovish stance, the Federal Reserve is readying for liftoff.

Technical analysis for the pair supports a bullish stance. Price action has broken major trendline resistance.

MACD confirms a bullish crossover on signal line and momentum is also with the bulls, raising scope for further upside.

Price action hovers around 88.6% Fib retracement at 116.66, bulls eyes upper month BB at 117.94. Bullish invalidation only below 55-EMA.