- USD/JPY hovers around 200-DMA, extends range trade for 2nd consecutive session.

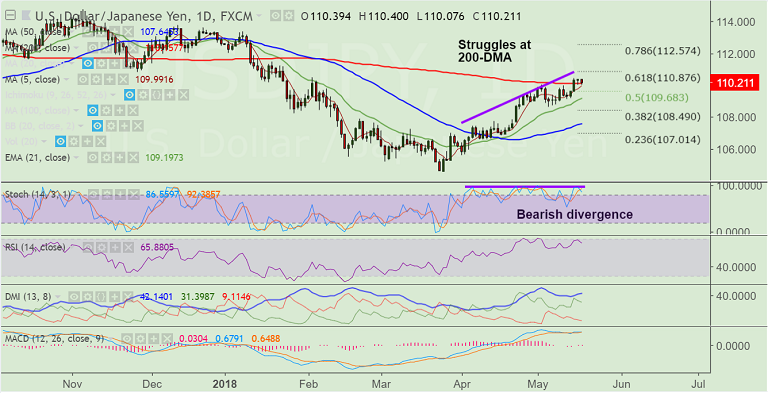

- USD bulls struggling to gain traction, the pair remains sandwiched below the 50-W SMA and above the 200-D SMA.

- The US dollar takes a breather despite 10-year yields rising to a fresh high since 2011 at 3.10%.

- The major has slipped lower from 3 1/2 month highs at 110.45, trades 0.14% lower on the day at 110.24 levels.

- Technical studies still support upside in the pair. That said, bearish divergence and 'Cypher Pattern' on daily charts keeps scope for downside.

- The major is struggling to hold gains above 200-DMA, retrace below will see further downside.

- Decisive close above 50W SMA at 110.32 raises scope for test of 61.8% Fib at 110.87 on bullish momentum.

- 20-DMA is strong support at 109.37 levels. Break below to see further weakness.

Support levels - 110, 109.99 (5-DMA), 109.37 (20-DMA)

Resistance levels - 110.32 (50W SMA), 110.87 (61.8% Fib), 111, 111.48 (Jan 18 high)

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.