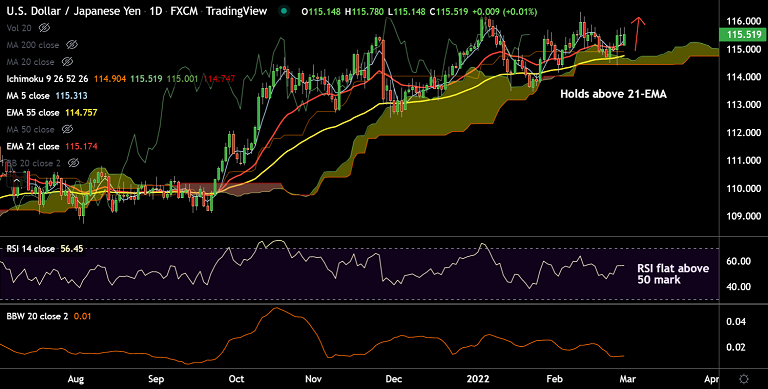

Chart - Courtesy Trading View

USD/JPY opened with a huge gap-down, but quickly pared losses to trade largely muted at 115.51 at around 04:37 GMT.

Western countries imposed harsher sanctions on Russia in response to the latter’s invasion of Ukraine.

However, sanctions did not deter President Vladimir to put nuclear arsenal on high alert, raising fears of a nuclear war.

Russian and Ukrainian officials are set to meet at the border with Belarus, but Ukrainian President Volodymyr Zelenskiy is skeptical about the talks.

A UK Times’ report says Russia ordered mercenaries 'to assassinate (Ukraine) President Zelenskyy and his government and prepare the ground for Moscow to take control' keeping tensions high.

On the data front, focus will be on the monthly US Nonfarm Payrolls (NFP) later this week as traders slow down on their hopes of a 0.50% rate hike in March.

Technical bias for the pair is bullish. Price action is holding above 21-EMA support and GMMA indicator shows major and minor trend are bullish.

Next major bull target lies at 116.30 (Wedge top). Breach below 55-EMA will drag the pair lower.