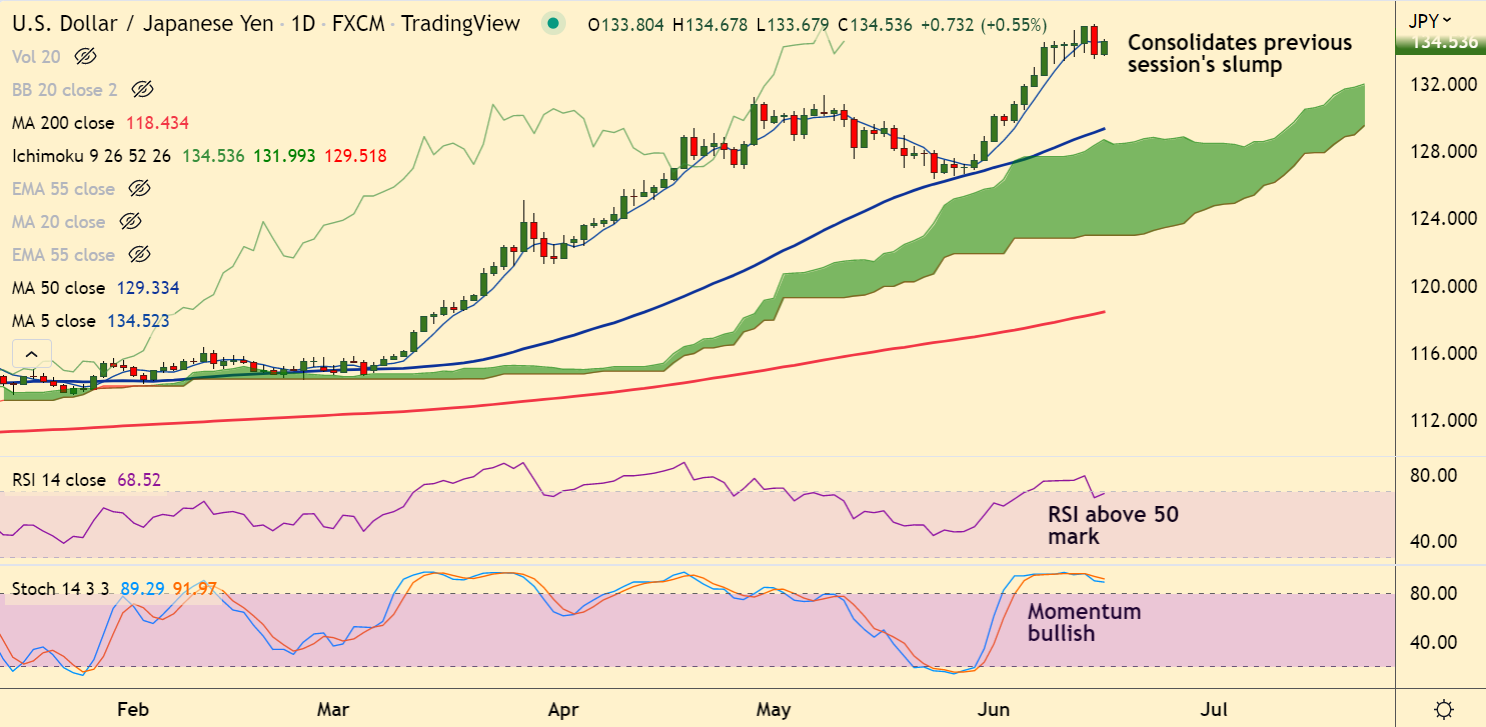

Chart - Courtesy Trading View

Fundamental Overview:

On Wednesday, the US Federal Reserve (Fed) raised key rate by 75 bps, Fed’s biggest hike since 1994.

The central bank also revised inflation forecasts for this year and the next while cutting down the inflation expectations.

Further, the policymakers also signaled either a 50 bp or 75 bp rate hike in the next meeting.

On the data front, US Retail Sales marked a contraction of 0.3% MoM versus an anticipated growth of 0.2% and downwardly revised 0.7% in previous readings.

Also, the NY Empire State Manufacturing Index dropped to -1.2 compared to 3.0 market consensus and -11.6 prior.

Focus now on the housing and activity data from the US along with Fed Chair Jerome Powell's speech for impetus.

Spot Analysis:

USD/JPY was trading 0.47% higher on the day at 134.42 at around 06:50 GMT.

Previous Week's High/ Low: 134.55/ 130.42

Previous Session's High/ Low: 135.59/ 133.50

Technical Analysis:

- USD/JPY consolidates previous session's slump

- Momentum is bullish, volatility is high

- Upside remains capped at 5-DMA

- Retrace has bounced off 200H MA

Major Support and Resistance Levels:

Support - 133.71 (200H MA), Resistance - 136.98 (Upper BB)

Summary: USD/JPY trades with a bullish bias. Breach below 200H MA could drag the pair lower. Bullish invalidation only below 21-EMA.

KiwiSaver shakeup: private asset investment has risks that could outweigh the rewards

KiwiSaver shakeup: private asset investment has risks that could outweigh the rewards  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UK Markets Face Rising Volatility as Hedge Funds Target Pound and Gilts

UK Markets Face Rising Volatility as Hedge Funds Target Pound and Gilts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stock Futures Rise as Trump Takes Office, Corporate Earnings Awaited

U.S. Stock Futures Rise as Trump Takes Office, Corporate Earnings Awaited  Tech Stocks Rally in Asia-Pacific as Dollar Remains Resilient

Tech Stocks Rally in Asia-Pacific as Dollar Remains Resilient  Why your retirement fund might soon include cryptocurrency

Why your retirement fund might soon include cryptocurrency  Why the Middle East is being left behind by global climate finance plans

Why the Middle East is being left behind by global climate finance plans  S&P 500 Surges Ahead of Trump Inauguration as Markets Rally

S&P 500 Surges Ahead of Trump Inauguration as Markets Rally