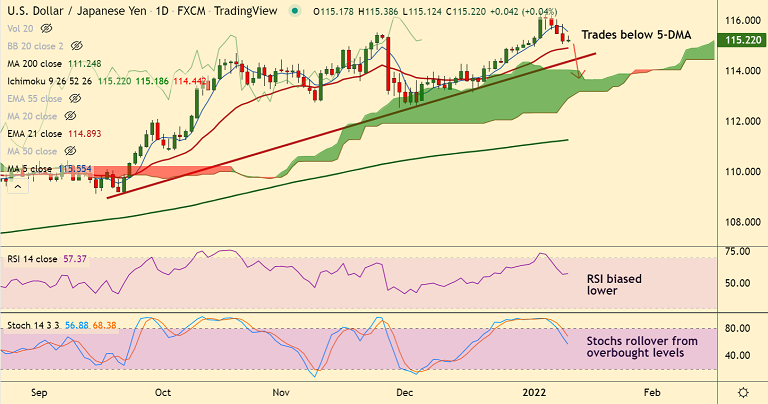

Chart - Courtesy Trading View

USD/JPY was trading 0.03% lower on the day at 115.15 at around 07:15 GMT, down from session highs at 115.38.

The pair is extending weakness for the 5th straight session, near-term bias has turned bearish.

Risk-off market mood benefitted the safe-haven Japanese yen and kept a lid on any meaningful gains for the major.

Further, retreating US Treasury yields weighed on the USD and aided further weakness in the pair.

Market focus remains on Fed Chair Jerome Powell's nomination hearing, due later during the US session on Tuesday.

US consumer inflation report due Wednesday will be looked upon for fresh clues on the timing and pace of policy normalisation by the Fed.

Markets remain optimistic about the US inflation data, with headline CPI expected to climb to a red-hot 7% year-on-year.

The report is likely to show core inflation climbing to its highest in decades at 5.4% and usher in a rate rise as soon as March.

Major Support Levels:

S1: 115

S2: 114.89 (21-EMA)

Major Resistance Levels:

R1: 115.55 (5-DMA)

R2: 116

Summary: USD/JPY near-term bias has turned bearish. Dip till 21-EMA at 114.89 likely. Further weakness only on break below.