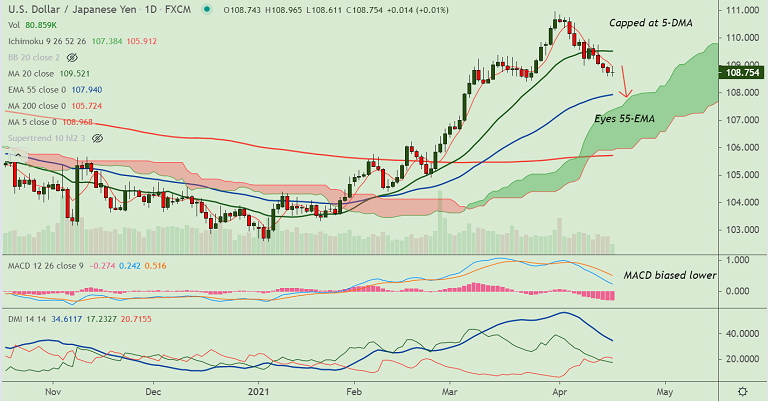

USD/JPY chart - Trading View

USD/JPY was trading unchanged at 108.78 at around 10:30 GMT, outlook remains bearish.

The major gained some upside traction in the European session, edged higher from session lows at 108.61.

Upbeat US macro data released on Thursday and rebounding US bond yields support the US dollar.

Upside however, looks limited as lack of strong follow-through caps gains. Upside rejected at 5-DMA.

The pair has now erased gains and has slipped lower from session highs at 108.96. A potential Doji formation on the daily candle dents upside.

Focus now on the release of Housing Starts, Building Permits and prelim Michigan Consumer Sentiment Index for trading opportunities.

Major trend in the pair is bullish, while near-term trend has turned bearish. Price action is extending weakness below 21-EMA and is on track to test 55-EMA at 107.94.