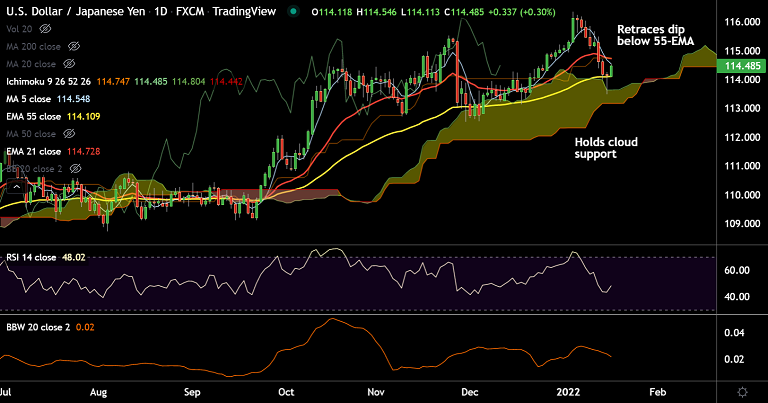

Chart - Courtesy Trading View

USD/JPY was trading 0.30% higher on the day at 114.48 at around 06:45 GMT.

The pair has bounced off daily cloud support and is extending gains after Dragonfly Doji formation in the previous session.

Bank of Japan (BoJ) is likely to stay pat at its event on Tuesday amid uncertain near-term growth and weaker inflation outlook.

Analysts expect the BoJ will not be tightening anytime soon and will maintain its massive stimulus, possibly at least until FY2023.

Japan's Finance Minister Shunichi Suzuki told parliament on Monday that they will strive to stably issue Japanese government bonds worth 215 trillion yen, $1.89 trillion, in the next fiscal year through close dialogue with markets, Reuters reports.

Major Support Levels:

S1: 114.10 (55-EMA)

S2: 114

S3: 113.66 (Lower BB)

Major Resistance Levels:

R1: 114.54 (5-DMA)

R2: 114.72 (21-EMA)

R3: 114.91 (20-DMA)

Summary: USD/JPY trades with neutral bias. The pair is extending gains after Doji formation in the previous session. Price action has retraced dip below 55-EMA. Focus on BoJ policy meet for impetus.