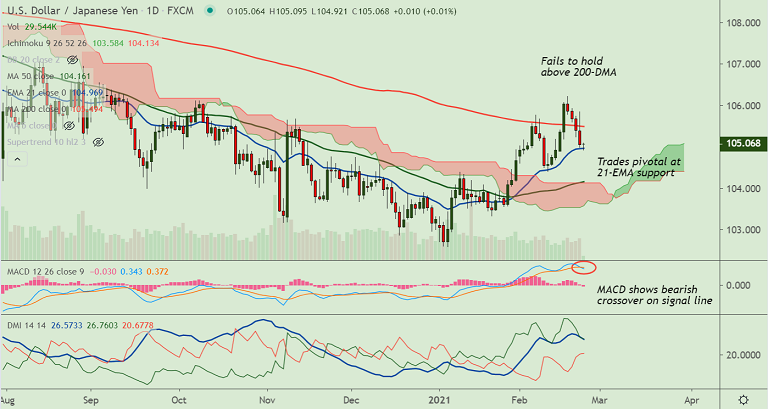

USD/JPY chart - Trading View

USD/JPY is extending the corrective pullback for the 5th straight session, trades pivotal at 21-EMA support.

The major has erased some of the early losses, edges higher from session lows at 104.92 and was trading largely unchanged at 105.05 at around 05:50 GMT.

USD/JPY bears are seen gradually firming up their grip as price action fails to extend break above 200 day moving average.

The pair seems to face rejection at 55W EMA for the 4th consecutive week. Any meaningful upside only on decisive break above.

MACD shows a bearish crossover on signal line which add to the downside sentiment. GMMA indicator has turned bearish on the intraday charts.

Major supports are seen at 104.96 (21-EMA) ahead of 104.70 (nearly converged 110-EMA and 21W EMA). While resistances align at 105.49 (200 DMA) ahead of 105.80 (55W EMA).

USD/JPY capped between 55 and 21 week EMAs. Breakout will provide a clear directional bias. Markets await Powell’s bi-annual testimony which will be the key amid the rising reflation fears.