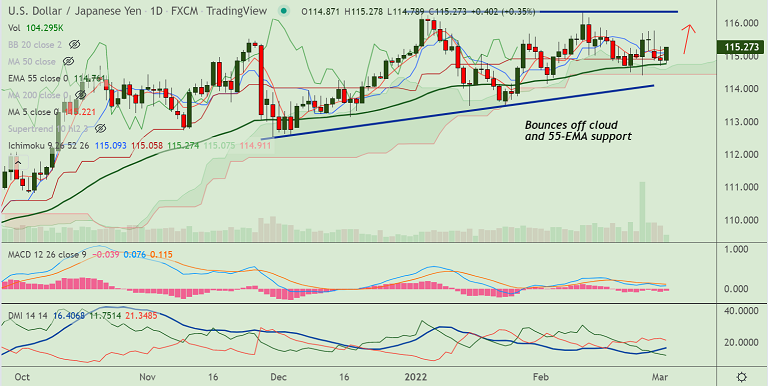

Chart - Courtesy Trading View

Spot Analysis:

USD/JPY was trading 0.31% higher on the day at 115.22 at around 10:10 GMT

Previous Week's High/ Low: 115.76/ 114.40

Previous Session's High/ Low: 115.28/ 114.69

Fundamental Overview:

US dollar remains bid as the sentiment remains dampened by global growth worries.

Diminishing odds for a 50 bps Fed rate hike move in March held back the USD bulls from placing aggressive bets and capped upside in the pair.

US ADP report and Fed Chair Jerome Powell's semi-annual testimony before the House Financial Services Committee will be in focus.

Geopolitical headlines amid the resumption of the Russia-Ukraine talks on Wednesday will impact price action.

Technical Analysis:

- USD/JPY snaps downside ahead of daily cloud support

- Price action has bounced off 55-EMA support and has edged above 21-EMA

- The pair has broken above 200H MA and GMMA has turned bullish on the intraday charts

- Momentum indicators do not show a clear directional bias

Major Support and Resistance Levels:

Support - 114.76 (55-EMA), Resistance - 115.86 (Upper BB)

Summary: USD/JPY was trading with a neutral bias. Decisive break above 20-DMA will see more gains.