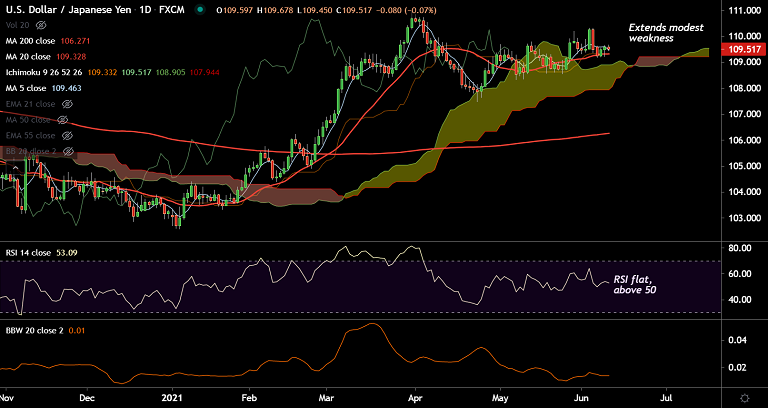

USD/JPY chart - Trading View

USD/JPY was trading largely unchanged at around 109.56 at around 09:45 GMT, outlook still bullish.

The pair has snapped 2 straight sessions of gains and price action remains capped below 200H MA.

Markets turn cautious amid risk-off mood, ahead of the crucial US CPI data which will provide fresh cues on the Fed’s next monetary policy action amid rising inflationary risks.

The FOMC will be meeting on June 17th and any hints about taper will probably put upwards pressure on the U.S dollar, supporting upside in the pair.

Consensus forecasts expect the headline CPI to jump from 4.2% to 4.7% in May while the more followed measure, CPI ex Food & Energy (Core CPI), is likely to rise from 3.0% to 3.4% YoY.

Major supports to watch - 109.36 (21-EMA), 109, 108.88 (55-EMA)

Major resistances to watch - 109.61 (200H MA), 110.10 (Upper BB), 110.72 (Trendline)

Summary: Major technical bias remains bullish, but subdued/range-bound price action likely amid the prevalent cautious mood.