- USD/JPY extends post-NFP rally, is attempting another run towards 111 handle.

- Friday’s solid US jobs report boosted the odds for a Dec Fed rate hike and lifted the yields higher across the curve.

- Focus now on US LMCI release and Fedspeaks for further momentum.

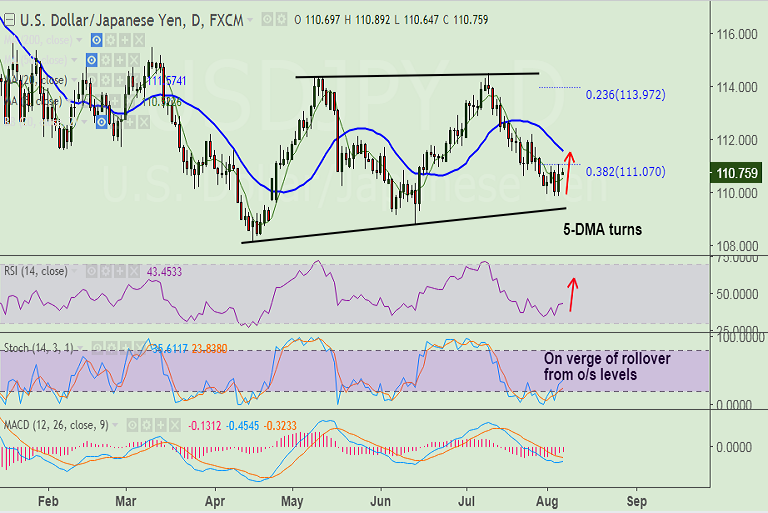

- Technically, we see scope for further gains. Stochs are on verge of rollover from oversold levels, support upside on confirmation.

- The pair has breached 200-SMA at 110.73 on hourly charts, finds next major resistance at 111.07 (38.2% Fib).

- Break above will take the pair higher, test of 20-DMA at 111.57 then likely.

Support levels - 110.73 (1H 200-SMA), 110.53 (5-DMA), 110, 109.40 (trendline)

Resistance levels - 111.07 (38.2% Fib retrace of 98.787 to 118.662 rally), 111.40 (cloud base), 111.57 (20-DMA)

Recommendation: Good to go long on dips around 110.60/70, SL: 109.80, TP: 111/ 111.25/ 111.55

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest