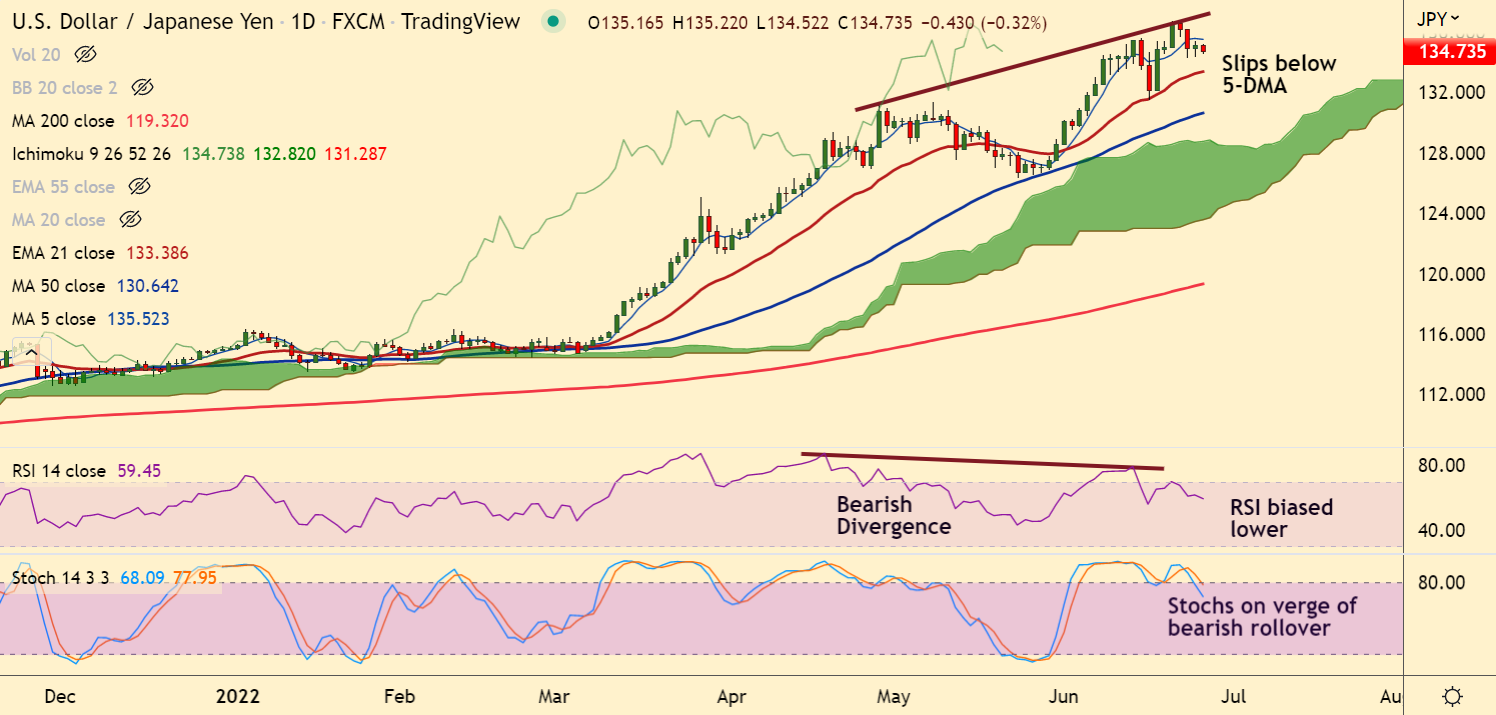

Chart - Courtesy Trading View

USD/JPY was trading 0.33% lower on the day at 134.72 at around 04:40 GMT.

The pair is extending sideways grind below 5-DMA, technical indicators are turning bearish.

MACD is on verge of bearish crossover on signal line. Chikou span is biased lower.

RSI is biased lower. Stochs are on verge of bearish rollover from overbought levels.

Price action has slipped below 200H MA. GMMA indicator shows bearish shift on the intraday charts.

Bearish RSI divergence on the daily charts raises scope for further downside.

On the data front, focus remains on the US Durable Goods Orders and Pending Home Sales for May.

US Durable Goods Orders for May are expected at 0.1% versus 0.5% prior, while the Pending Home Sales is expected at -2.0% versus -3.9% prior.

Major Support Levels:

S1: 134

S2: 133.38 (21-EMA)

Major Resistance Levels:

R1: 134.91 (200H MA)

R2: 135.52 (5-DMA)

Summary: USD/JPY trades with a bearish bias. Dip till 21-EMA likely.