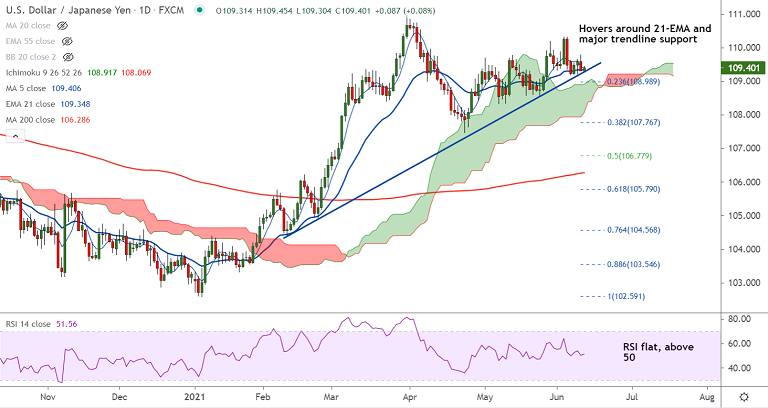

USD/JPY chart - Trading View

USD/JPY was trading 0.07% higher on the day at 109.40 at around 03:30 GMT, erasing some of the previous session's gains.

US Consumer Price Index data released overnight showed CPI rose 0.6%, with core up 0.7%, stronger than expected.

Also, on an annual basis, the US CPI rose 5.0% YoY which was the largest annual gain in more than a decade.

Data was largely in line with the Fed’s ‘transitory’ judgement and caused the bond market to price out Fed rate hike expectations.

''All in all, strong core data again, but the strength can probably still be viewed as "transitory" to a large extent, due to post-COVID reopening as well as fallout from the semiconductor shortage,'' noted analysts at TD Securities.

The 2-year government bond yields fell to 0.15%, while 10-year bond yields rose to 1.53% before tumbling down to 1.43%.

DXY, the dollar index was trading 0.09% lower on the day at 89.98 at around 03:30 GMT, extending previous session's weakness.

Markets brace for next week’s FOMC meeting. Fed policymakers have repeatedly tried rejecting the tapering woes. US Michigan consumer sentiment data in focus for fresh impulse.