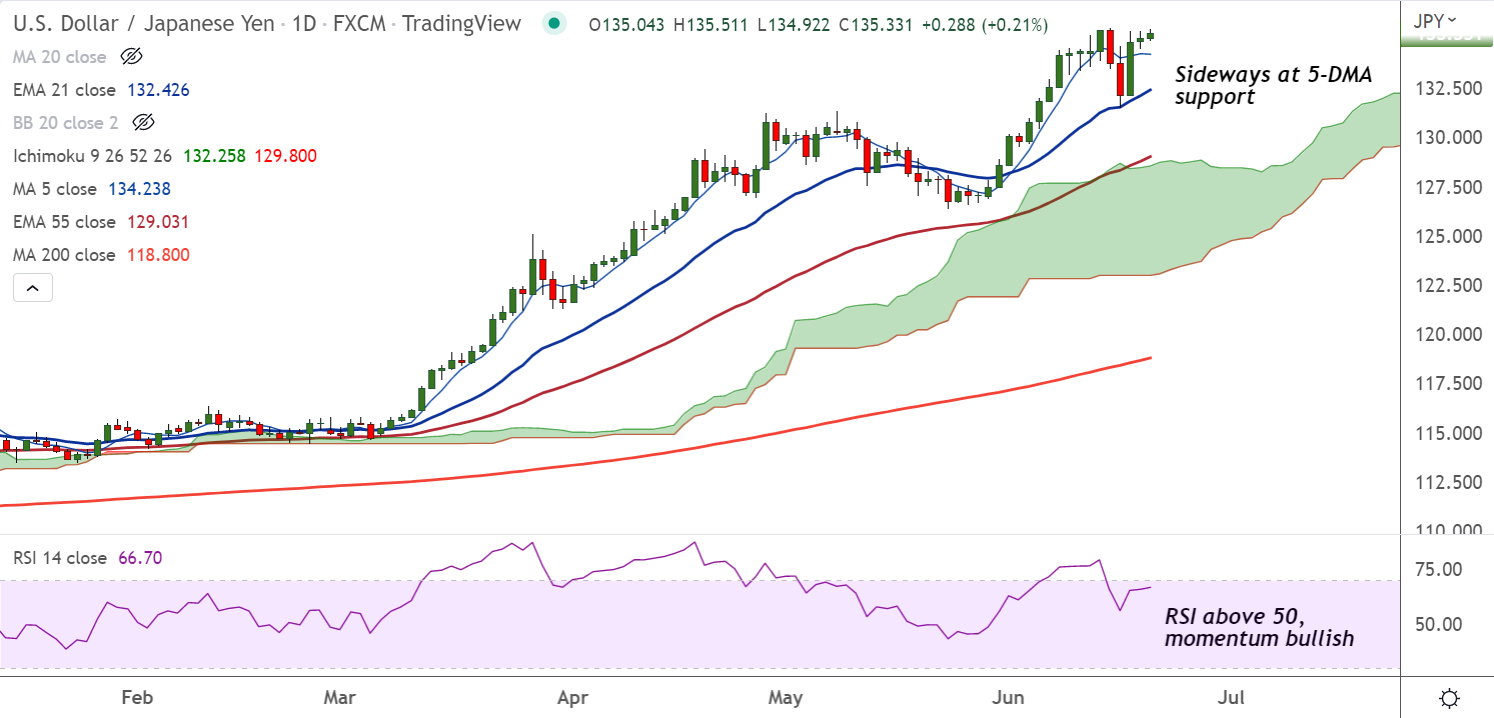

Chart - Courtesy Trading View

Technical Analysis:

- USD/JPY was trading 0.16% higher on the day at 135.25 at around 06:55 GMT

- The pair is extending sideways for the 2nd straight session, holds above 5-DMA

- Price action is consolidating bounce off 21-EMA support, major moving averages are trending higher

- Momentum is bullish and volatility is high, MACD supports upside in the pair

- GMMA indicator shows major and minor trend are bullish

Major Support Levels:

S1: 134.23 (5-DMA)

S2: 132.42 (21-EMA)

Major Resistance Levels:

R1: 136

R2: 136.15 (trendline)

Summary: USD/JPY extends sideways. A decisive move will be seen after the release of the Federal Reserve (Fed) chair Jerome Powell’s testimony. Traders will await any clues regarding the likely monetary policy action in July.