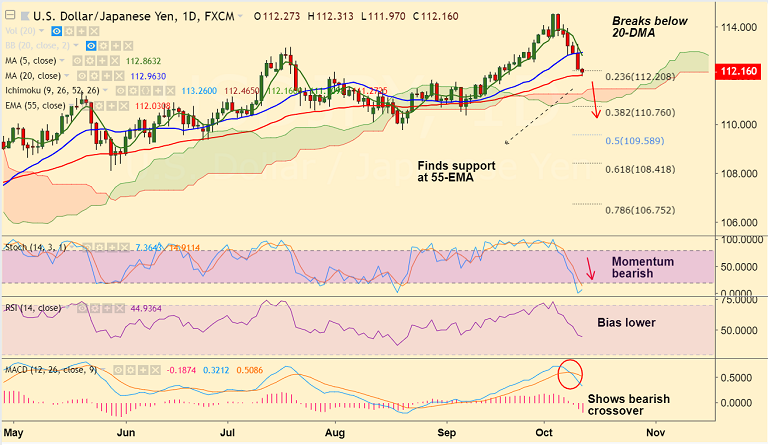

USD/JPY chart on Trading View used for analysis

- USD/JPY came under a renewed selling pressure on Wednesday, slumped over 0.35% to close at 112.27.

- Escalating concerns over the lack of progress on the trade conflict between the U.S. and China keep downside pressure.

- Data released on Wednesday was also unimpressive, further collaborated to the pair's heavily offered tone.

- US PPI print was largely inline with expectations, coming in at 0.2% m/m rise in wholesale prices. The y/y increase was slightly weaker at 2.6% as against 2.8% anticipated.

- Technical indicators on daily charts have turned bearish. Stochs are sharply lower. RSI is biased lower and MACD shows a bearish crossover on signal line.

- Break below 20-DMA has raised scope for further weakness. The pair is holding support at 55-EMA. Break below will accentuate weakness.

- Next major support is seen at daily cloud at 111.27, ahead of 38.2% Fib at 110.76.

- On the flip side, immediate resistance is seen at 5-DMA at 112.86. Retrace above 20-DMA invalidates bearish bias.

Call update: Our previous call (https://www.econotimes.com/FxWirePro-USD-JPY-retraces-above-113-handle-break-below-20-DMA-support-could-see-further-weakness-1440199) has hit TP1/2.

Recommendation: Book partial profits at lows, trail SL to 113, hold for further weakness.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.