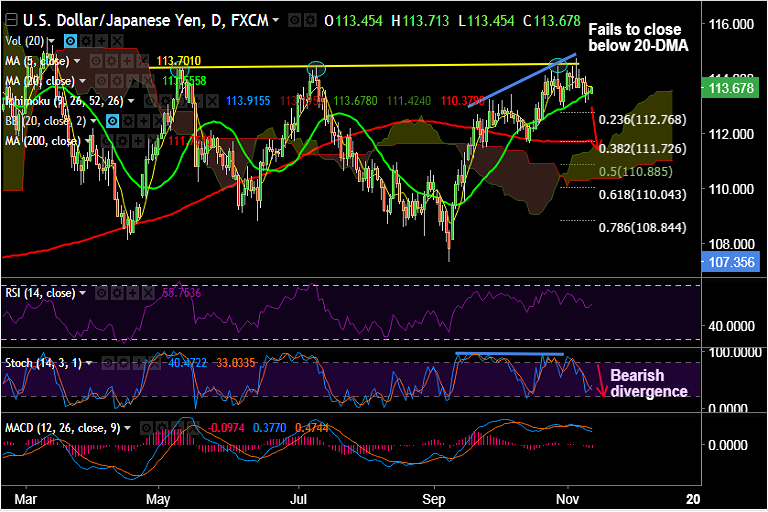

- USD/JPY struggles to close below 20-DMA which is offering strong support at 113.55.

- The pair has recovered from session lows at 113.45 and is currently hovering at 113.68, up 0.15% on the day.

- Last week's news of a possible delay in the US corporate tax cut plan may see the upside limited above 114.00.

- Data in focus this week includes US CPI, retail sales and industrial production, which could provide further direction.

- The coming week also brings several speeches by FOMC members, including Janet Yellen, who is due to speak on Tuesday.

- Break above 5-DMA could see test of major trendline resistance at 114.50.

- On the filpside we see weakness on break below 20-DMA, scope then for test of 112.76 (23.6% Fib)

Support levels - 113.55 (20-DMA), 112.98 (23.6% Fib retrace of 107.318 to 114.73 rally), 112.16 (50-DMA)

Resistance levels - 113.70 (5-DMA), 114, 114.50 (trendline)

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest