- A renewed risk-aversion wave gripped markets on North Korea threats, boosting the safe-haven flows for the Yen.

- Also, the Greenback is paring some of the FOMC-led gains, which is adding to downside pressure on USD/JPY.

- The major is down 0.55% on the day, trading at 111.83 after hitting session lows at 111.65.

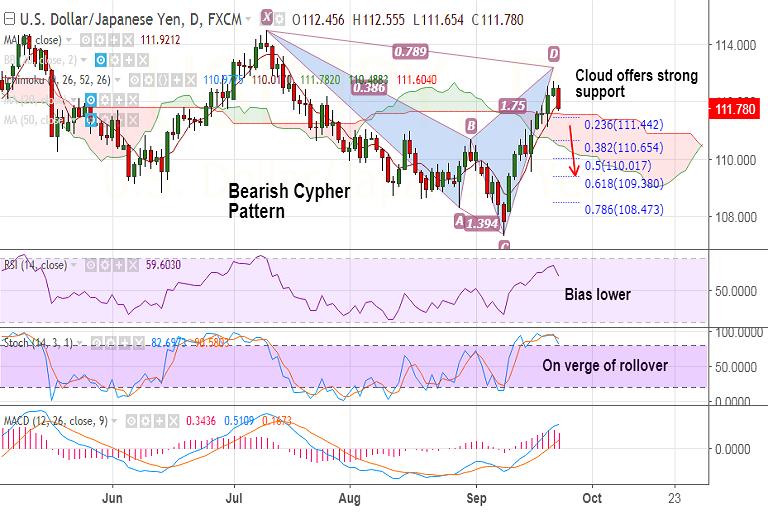

- Daily cloud at 111.60 offers strong support on the downside, we see further weakness on break below.

- The pair has completed a 'Bearish Cypher' pattern which adds scope for downside.

- Break below 111.60 is likely to see test of 50-DMA at 110.34. Bearish invalidation above 112.95.

Support levels - 111.60 (cloud top), 111, 110.34 (50-DMA)

Resistance levels - 112.93 (5-DMA), 112.95 (78.6% Fib retracement of 114.495 to 107.318 fall), 113, 114.36 (double top)

Recommendation: Good to go short on break below 111.60, SL: 112.50, TP: 111/ 110.35/ 110

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest