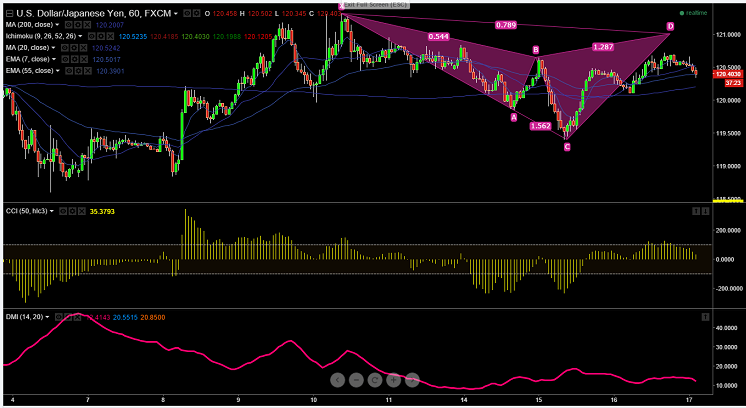

Pattern formed- Bearish cypher

Potential Reversal Zone (PRZ)- 121.30

- USD/JPY is consolidating between 119.60 and 120.75 for the past two trading session on account of FOMC meeting which is to be held on Sep 17th 2015.

- Any further movement can happen above or below this level. On the lower side any break below confirms short term weakness a decline till 118.80/118.20 cannot be ruled out.

- The pair's minor intraday resistance is around 120.75 and break above would extend gains till 121.30/121.70.

It is good to sell on rallies around 120.85-90 with SL around 121.40 for TP of 119.80/119.50