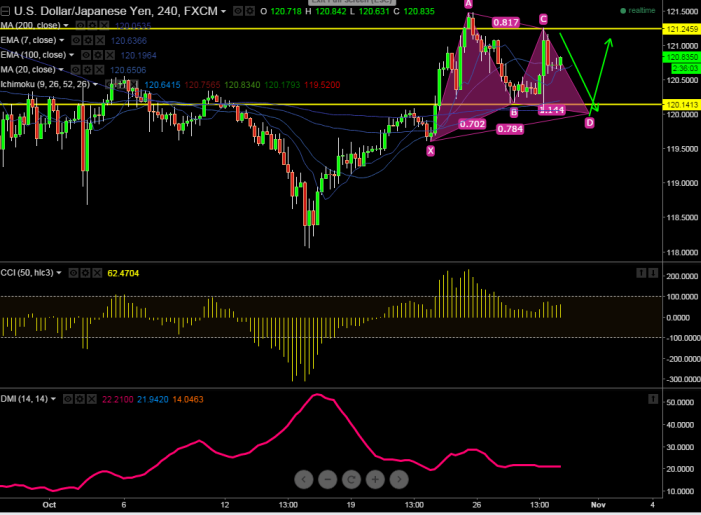

Harmonic pattern - Bullish Gartley pattern

Potential Reversal Zone (PRZ) -121.35

- USD/JPY has made a high of 121.25 and declined from that level. It is currently trading at 120.78.

- On the downside major support is around 120.50 and break below targets 120/119.60 level.

- Short term bullish invalidation only below 119.60.

- The pair's major resistance is around 121.50 and indicative break above will take the pair to next level to 122/122.30.

It is good to sell on rallies around 120.95-121 with SL around 121.35 for the TP of 120.05.