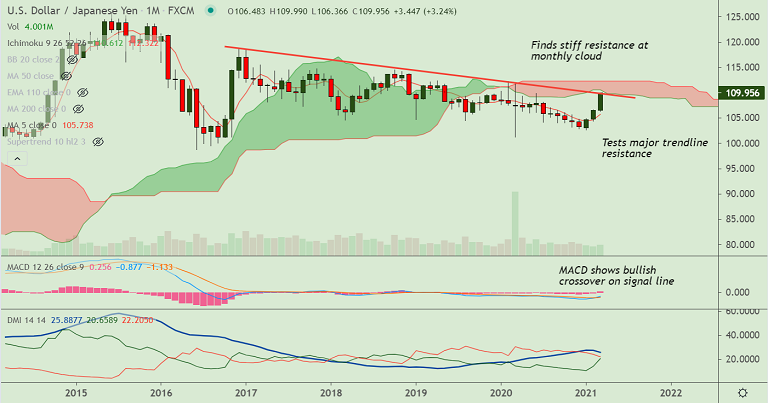

USD/JPY chart - Trading View

USD/JPY was trading 0.16% higher on the day at 109.95 at around 04:50 GMT, outlook is bullish.

The pair bounced off session lows on Monday's trade and closed the day's trade with a Dragonfly Doji formation.

Price action is extending break above 200W MA and is on track to test month cloud resistance.

Speaking on the economic and monetary policy outlooks, BoJ's Kuroda said the impact of COVID-19 on Japan's economy to persist for prolonged period.

USD/JPY extends gains after Kuroda's comments, hits 12-month high just shy of 110 handle.

Technical bias is strongly bullish. The pair is extending gains above 55-month EMA. GMMA indicator shows major and minor trend are strongly bullish.

The major is extending gains for the 3rd straight month, MACD is showing a bullish crossover on signal line on the monthly charts.

Major trendline resistance is seen at 110 mark. Break above eyes next bull target lies at 88.6% Fib at 110.67.