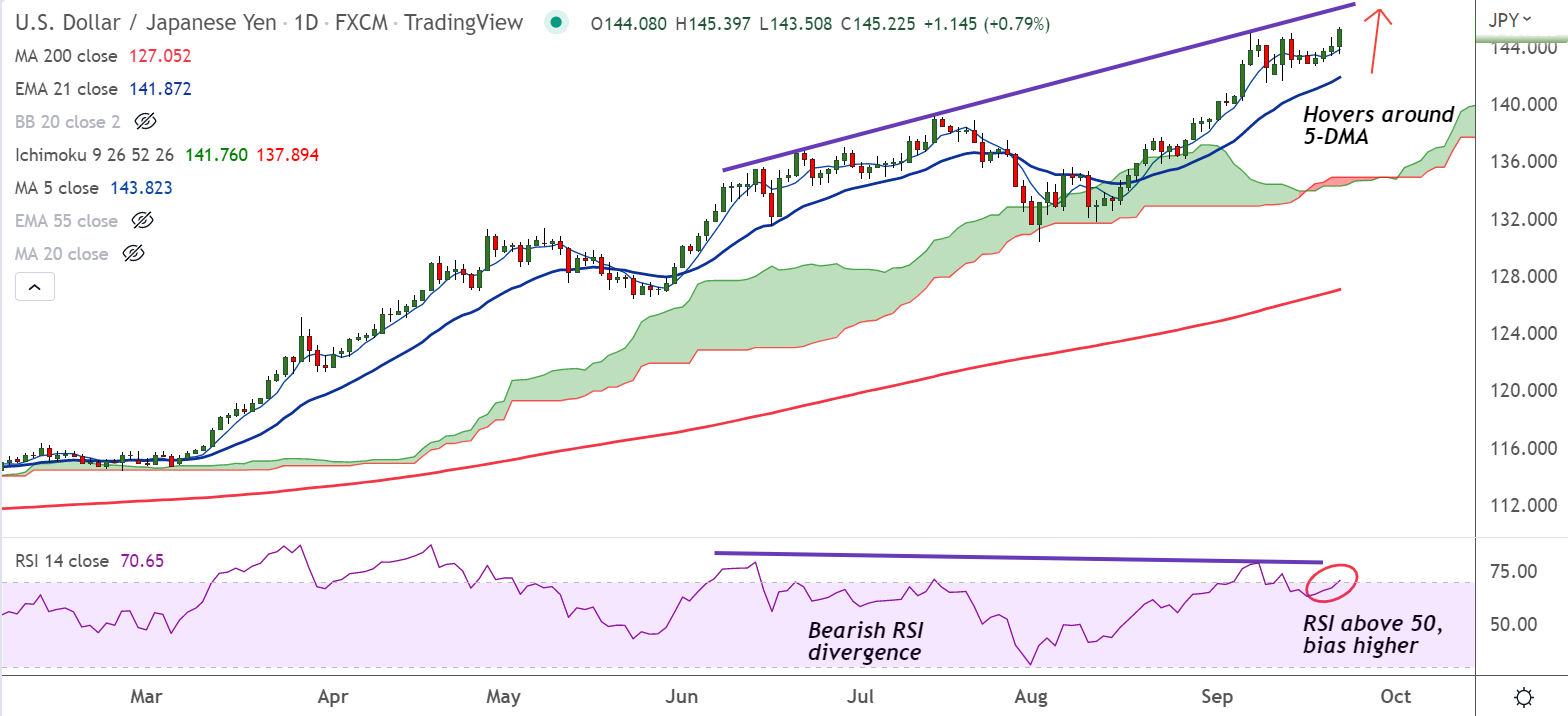

Chart - Courtesy Trading View

USD/JPY was trading 0.61% higher on the day at 144.98 at around 06:10 GMT.

The major has hit new 20-year high above 145 handle before paring some gains.

DXY extended gains after the Federal Reserve raised interest rates and struck a more hawkish tone than expected in its latest meeting.

The Federal Reserve on Wednesday raised interest rates by 75 basis points, as expected.

Chairman Jerome Powell warned that the bank will keep hiking rates at a sharp clip, even risking pressure on economic growth and the labor market, as it struggles to rein in runaway inflation.

The hawkish comments cemented expectations that U.S. interest rates will end the year well above 4% - their highest level in over 14 years, boosting the dollar across the board.

Further, signs of a potential escalation in the Russia-Ukraine conflict added support to the dollar.

Technical Analysis:

- USD/JPY trades with a strong bullish bias, scope for further upside

- GMMA indicator shows major and minor trend are strongly bullish

- Price action is above major moving averages which are trending higher

- Stochs and RSI show momentum is strongly bullish, oscillators are in overbought territory

Major Support Levels: 143.86 (5-DMA), 141.89 (21-EMA)

Major Resistance Levels: 146.53 (Upper BB), 146.90 (Rising trendline)

Summary: USD/JPY trades with a bullish bias, the pair is on track to test trendline resistance at 146.90.