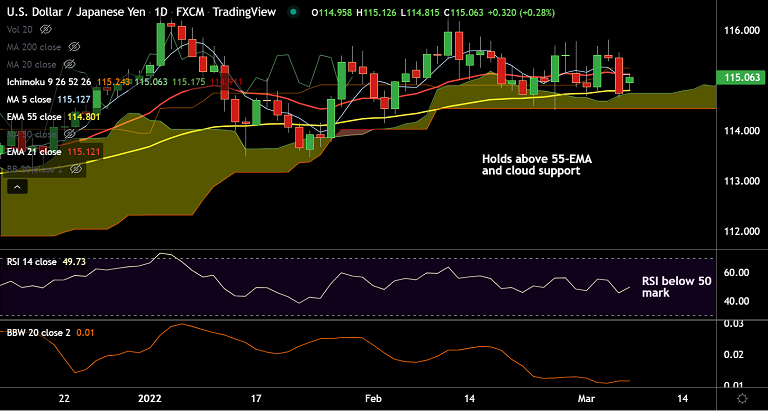

Chart - Courtesy Trading View

USD/JPY was trading 0.26% higher on the day at 115.04 at around 09:50 GMT.

The pair has paused downside at 55-EMA and daily cloud support, weakness only on break below.

Soaring oil prices over a potential ban on Russian crude supplies, stoke inflation shock in the global economy.

The International Monetary Fund (IMF) warned in a weekend report that Russia-Ukraine conflict escalation would cause 'devastating' economic damage.

Key central banks will now have to balance tightening monetary policy to curb inflation without impacting economic growth and risky assets.

Technical bias for the pair is neutral. Indicators are inconclusive and fail to provide a clear directional bias.

Bearish RSI divergence on the weekly charts keeps scope for weakness. MACD and ADX support weakness.

Break below daily cloud will see dip till major trendline support at 114.15. Next major support lies at 113.97 (110-EMA).