- USD/JPY clings to gains above 109.00 handle, trades 0.48% higher at 109.34.

- US core Personal Consumption Expenditure (PCE) price index year-on-year to April matched analysts expectations at 1.8%.

- A goodish pickup in the US Dollar demand was seen supported by resurgent US Treasury bond yields.

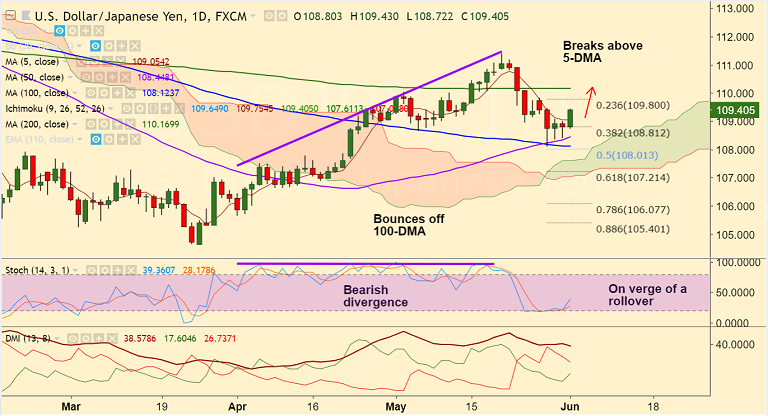

- USD/JPY recovered from new 4-week lows at 108.11, breaks above 5-DMA, further upside likely.

- Currently we see strong support at 50-DMA at 108.44, break below to see further weakness.

- Upbeat non-farm payroll data could see further upside. Scope then for test of 200-DMA at 110.17

Support levels - 109.04 (5-DMA), 108.44 (50-DMA), 108.12 (100-DMA), 108, 107.65 (Apr 23 low)

Resistance levels - 109.80 (23.6% Fib), 110, 110.16 (200-DMA)

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -96.8004 (Bearish), while Hourly JPY Spot Index was at -77.1223 (Neutral) at 1145 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.