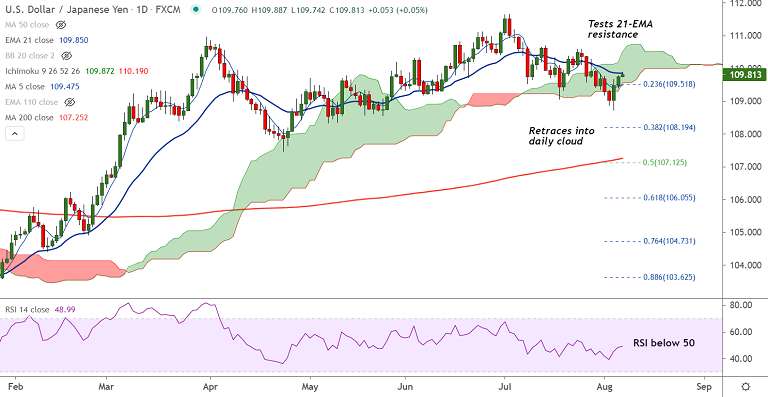

USD/JPY chart - Trading View

USD/JPY was trading 0.06% higher on the day at 109.84 at around 06:30 GMT.

The pair trades in tight range with session high at 109.88 and low at 109.74 ahead of the crucial NFP data.

U.S. Labor Department's closely watched employment report on Friday could show nonfarm payrolls surging last month due to seasonal adjustment factors.

According to a Reuters survey of economists, nonfarm payrolls likely increased by 870,000 jobs last month after rising 850,000 in June.

Unemployment rate is seen falling to 5.7% from 5.9%, while average hourly earnings forecast rising 0.3%.

Escalating covid woes and US Senators’ delay in announcing infrastructure spending plan keep risk sentiment sour.

Technical analysis shows a slight bullish shift on the intraday charts. Price action has edged above 200H MA.

Pullback has bounced off 110-EMA support and has retraced into daily cloud. Bulls are testing resistance at 21-EMA, break above will fuel further gains.