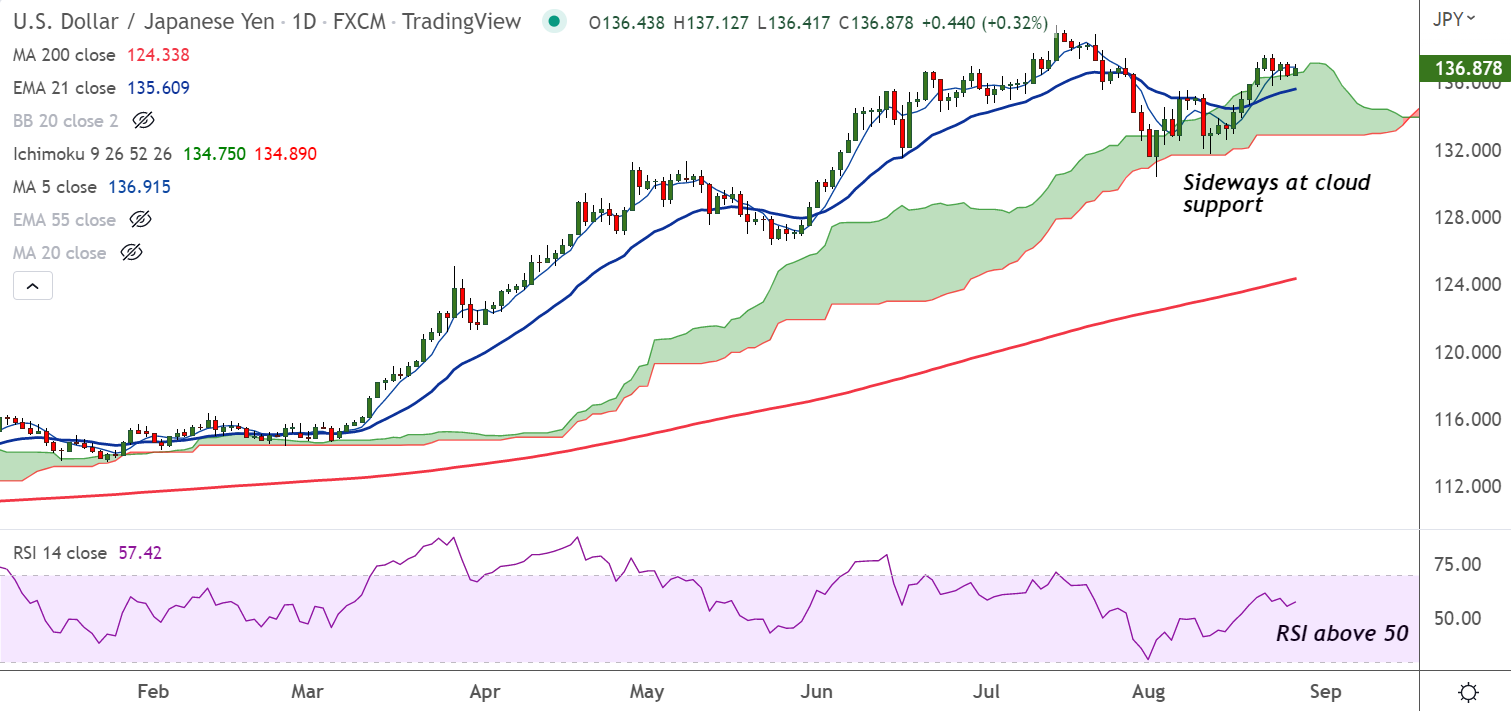

Chart - Courtesy Trading View

USD/JPY was trading 0.32% higher on the day at 136.87 at around 09:25 GMT.

The pair is extending sideways grind at cloud top support, weakness only on retrace below.

Price action is above major moving averages and volatility is high and rising. RSI is above 50 and momentum is bullish.

GMMA indicator shows major and minor trend are bullish. The pair trades above 200H MA.

Traders remain cautious ahead of central banks' governors speech within the Jackson Hole Economic Symposium.

US dollar remains buoyed as Fed Powell’s commentary at Jackson Hole Economic Symposium is expected to remain hawkish on interest rates.

Focus also on the US Core Personal Consumption Expenditure (PCE) data, which is expected to decline to 4.7% from the prior print of 4.8%.

Major Support Levels:

S1: 136.55 (Cloud top)

S2: 135.72 (50-DMA)

Major Resistance Levels:

R1: 136.90 (5-DMA)

R2: 138.16 (Upper BB)

Summary: USD/JPY trades with a neutral bias. Major weakness only below daily cloud.