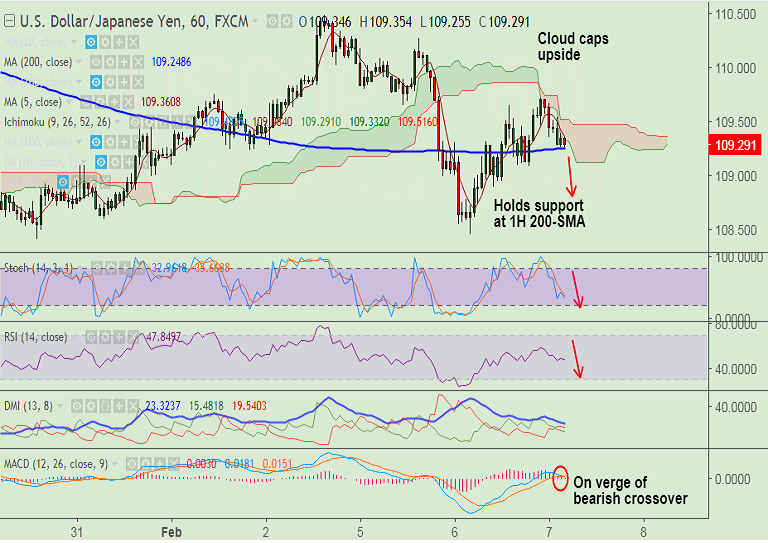

- USD/JPY finds stiff resistance at 20-DMA at 109.95, we see upside only on decisive break above.

- Recovery in the pair after recovery in the stock markets in the previous day's trade failed to extend.

- Price has slipped below 5-DMA and on intraday charts we see some weakness.

- Price action is holding support by 1H 200-SMA at 109.25, we see weakness on break below.

- Upside seems to be capped by hourly Ichimoku cloud, price gradually extending decline.

- Break below 1H 200-SMA could see drag till 108.90 (78.6% Fib) ahead of 108.40 (rising trendline).

Support levels - 109.25 (1H 200-SMA), 108.90 (78.6% Fib retrace of 107.318 to 114.737 rally), 108.40 (trendline)

Resistance levels - 109.48 (5-DMA), 109.95 (20-DMA), 110.15 (61.8% Fib)

Recommendation: Good to go short on break below 1H 200-SMA, SL: 109.95, TP: 108.90/ 108.40/ 108.15.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest