- USD/JPY extending weakness below 5-DMA, trades 0.09% lower on the day.

- Markets remain risk averse, keeping demand for JPY and hence downside pressure on the pair.

- The United States is due to impose the tariffs on Chinese exports.on July 6.

- China on the otherside has reiterated that the its retaliatory tariffs on US goods will take effect immediately after US tariffs on Chinese imports kick in.

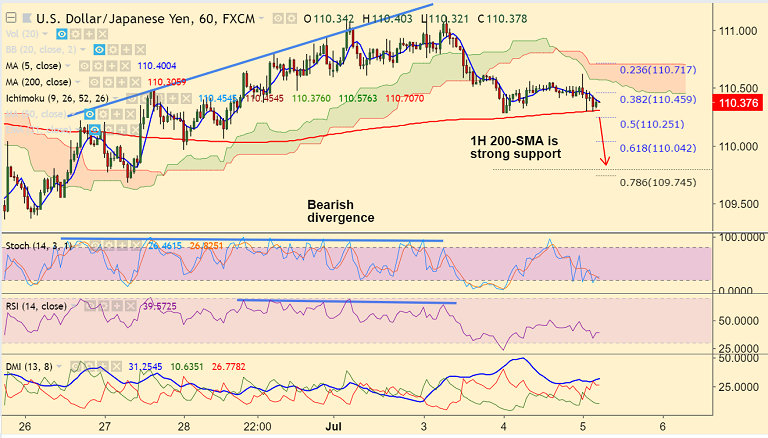

- Technical indicators on hourly charts have turned bearish. We also find bearish divergence which adds to the bearish bias.

- Price action currently finds strong support at 1H 200-DMA at 110.30. Break below to see further downside.

- On the flipside, decisive break above 111 handle negates bearish bias.

Support levels - 110.30 (1H 100-SMA), 110 (61.8% Fib), 109.75 (78.6% Fib)

Resistance levels - 110.60 (5-DMA), 111, 111.40 (May 21 high)

Recommendation: Good to go short on break below 1H 200-SMA (110.30), SL: 110.65, TP: 110/ 109.75/ 109.60

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -31.2005 (Neutral), while Hourly JPY Spot Index was at 26.7053 (Neutral) at 0500 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.