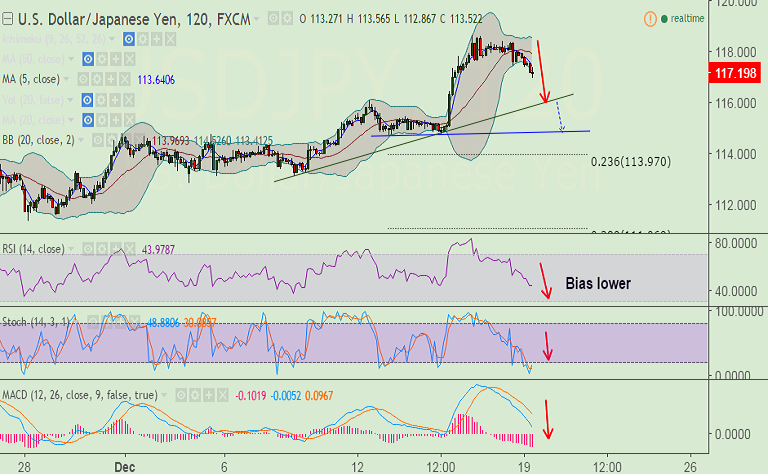

- USD/JPY extends downside for 2 consecutive day. Intraday bias lower.

- The pair is just holding support by 5-DMA at 117.07. Break below will see further drag.

- We see scope for test of trendline support at 116. Further weakness could see test of 114.80.

- Support levels - 117.09 (5-DMA), 116 (trendline support), 114.75 (trendline), 113.97 (23.6% Fib)

- Resistance levels - 117.97 (session high), 118.42 (Dec 16 high), 118.66 (Dec 15 high)

Recommendation: Short USD/JPY rallies around 117.30, SL: 118, TP: 116.50/ 116/ 115.50/ 114.80

FxWirePro's Hourly USD Spot Index was at 60.5242 (Neutral), while Hourly JPY Spot Index was at 66.7473 (Neutral) at 0735 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.