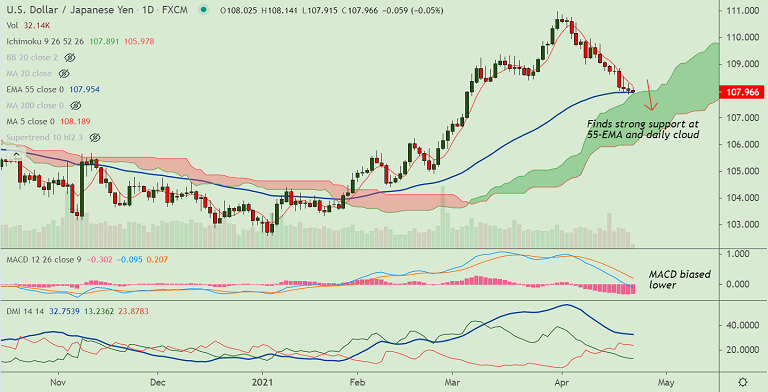

USD/JPY chart - Trading View

USD/JPY was trading 0.05% lower on the day at 107.96 at around 05:00 GMT.

US dollar remains on the back foot across the board amid a rebound in the global stocks.

The pair is grinding lower for the 9th straight session, trades below 108 handle, outlook remains bearish.

Momentum studies support downside, Stochs and RSI are sharply lower, RSI is well below the 50 mark.

Volatility is high and rising as evidenced by widening Bollinger bands. Analysis of GMMA indicator shows near-term bias has turned bearish.

COVID-19 conditions across Asia along with US stimulus deadlock and geopolitical-tensions challenge risk-on mood.

The pair finds strong support on the downside at 55-EMA and daily cloud. Break below will open downside.